The …

Comprehensive Insurance Guide for Engine Parts Manufacturers: Protecting Your Business's Future

Understanding the Unique Insurance Landscape for Engine Parts Manufacturers

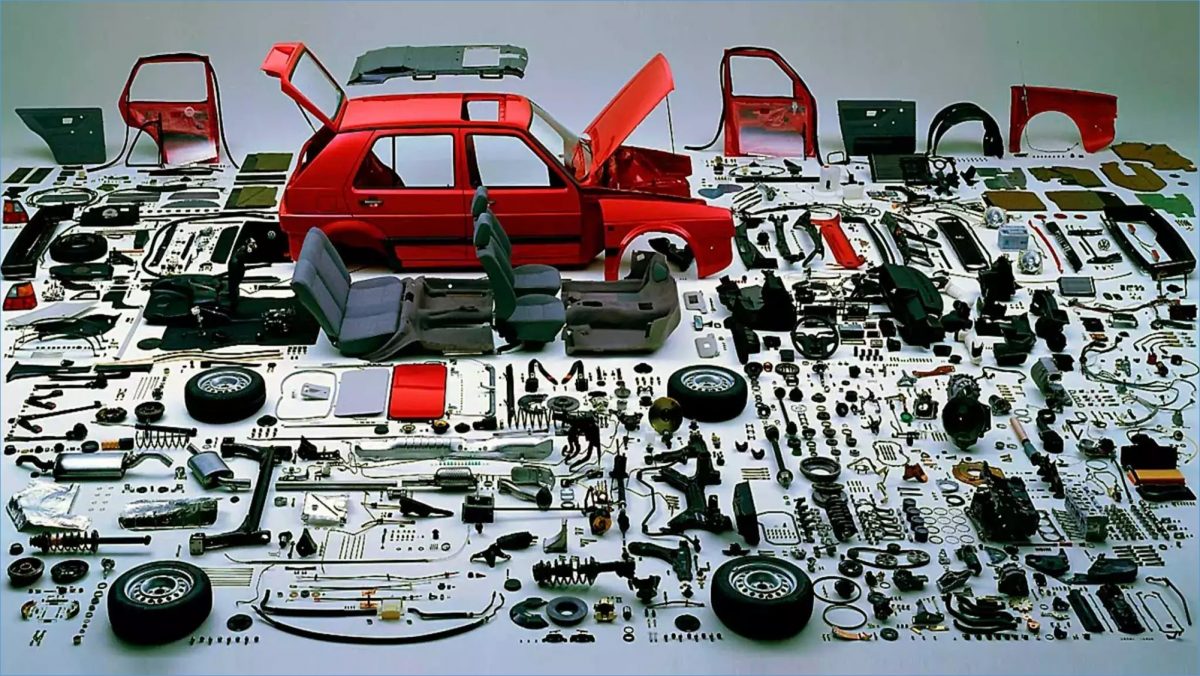

The engine parts manufacturing sector is a critical component of the automotive and industrial machinery supply chain. With complex manufacturing processes, high-value equipment, and significant liability risks, having the right insurance coverage isn't just recommended—it's essential for survival and success.

Key Risk Factors in Engine Parts Manufacturing

- Product Liability Risks: Potential failures or defects in manufactured engine components

- Equipment Breakdown: Costly machinery failures and production interruptions

- Supply Chain Disruptions: Risks associated with just-in-time manufacturing models

- Workplace Safety: Complex manufacturing environments with multiple hazards

- Intellectual Property: Protection of design specifications and manufacturing processes

Essential Insurance Coverage for Engine Parts Manufacturers

1. Commercial Combined Insurance

A comprehensive policy that integrates multiple coverage types, including:

- Property damage protection for manufacturing facilities

- Equipment and machinery coverage

- Business interruption insurance

- Stock and inventory protection

2. Product Liability Insurance

Critical for engine parts manufacturers, this insurance protects against:

- Legal claims arising from defective engine components

- Potential financial losses from product recalls

- Compensation for damages caused by manufacturing errors

- Legal defense costs in product-related litigation

3. Professional Indemnity Insurance

Protects against professional errors and design-related risks, covering:

- Engineering design mistakes

- Specification errors

- Consultancy and technical advice liability

- Intellectual property disputes

4. Cyber Insurance

Essential in modern manufacturing with increasing digital integration:

- Protection against data breaches

- Coverage for industrial control system attacks

- Business interruption from cyber incidents

- Restoration of digital assets and systems

5. Employers' Liability Insurance

Mandatory coverage protecting your workforce:

- Workplace injury compensation

- Occupational disease claims

- Legal compliance for worker protection

- Medical expense and rehabilitation coverage

Effective Risk Management Strategies

Beyond insurance, successful engine parts manufacturers implement comprehensive risk management:

- Regular Equipment Maintenance: Preventative checks to minimize breakdown risks

- Quality Control Systems: Rigorous testing and certification processes

- Employee Training: Continuous safety and technical skill development

- Supply Chain Diversification: Reducing dependency on single suppliers

- Cybersecurity Protocols: Robust digital protection mechanisms

Factors Influencing Insurance Premiums

Insurance costs for engine parts manufacturers depend on multiple variables:

- Annual revenue and production volume

- Types of engine parts manufactured

- Manufacturing technologies used

- Historical claim records

- Workplace safety standards

- Quality management systems

Emerging Trends in Manufacturing Insurance

The insurance landscape for engine parts manufacturers is evolving with technological advancements:

- AI-driven risk assessment

- Usage-based insurance models

- Integration of IoT for real-time risk monitoring

- Customized coverage for electric and hybrid vehicle components

Securing Your Manufacturing Future

Engine parts manufacturing is a high-stakes industry where precision, reliability, and risk management are paramount. The right insurance strategy isn't just about protection—it's about creating a resilient business framework that can adapt, grow, and thrive.

By understanding your unique risks and implementing comprehensive insurance coverage, you transform potential vulnerabilities into strategic advantages.

Frequently Asked Questions

Q: How often should engine parts manufacturers review their insurance?

A: Annually, or whenever significant changes occur in business operations, technology, or market conditions.

Q: Can insurance cover prototype and R&D risks?

A: Specialized professional indemnity and product liability policies can be tailored to cover research and development stages.

Q: What's the most critical insurance for a new engine parts manufacturer?

A: Product liability and commercial combined insurance provide foundational protection for new manufacturers.

0330 127 2333

0330 127 2333