Trade Credit Insurance for Battery Manufacturers: Safeguarding Your Financial Future

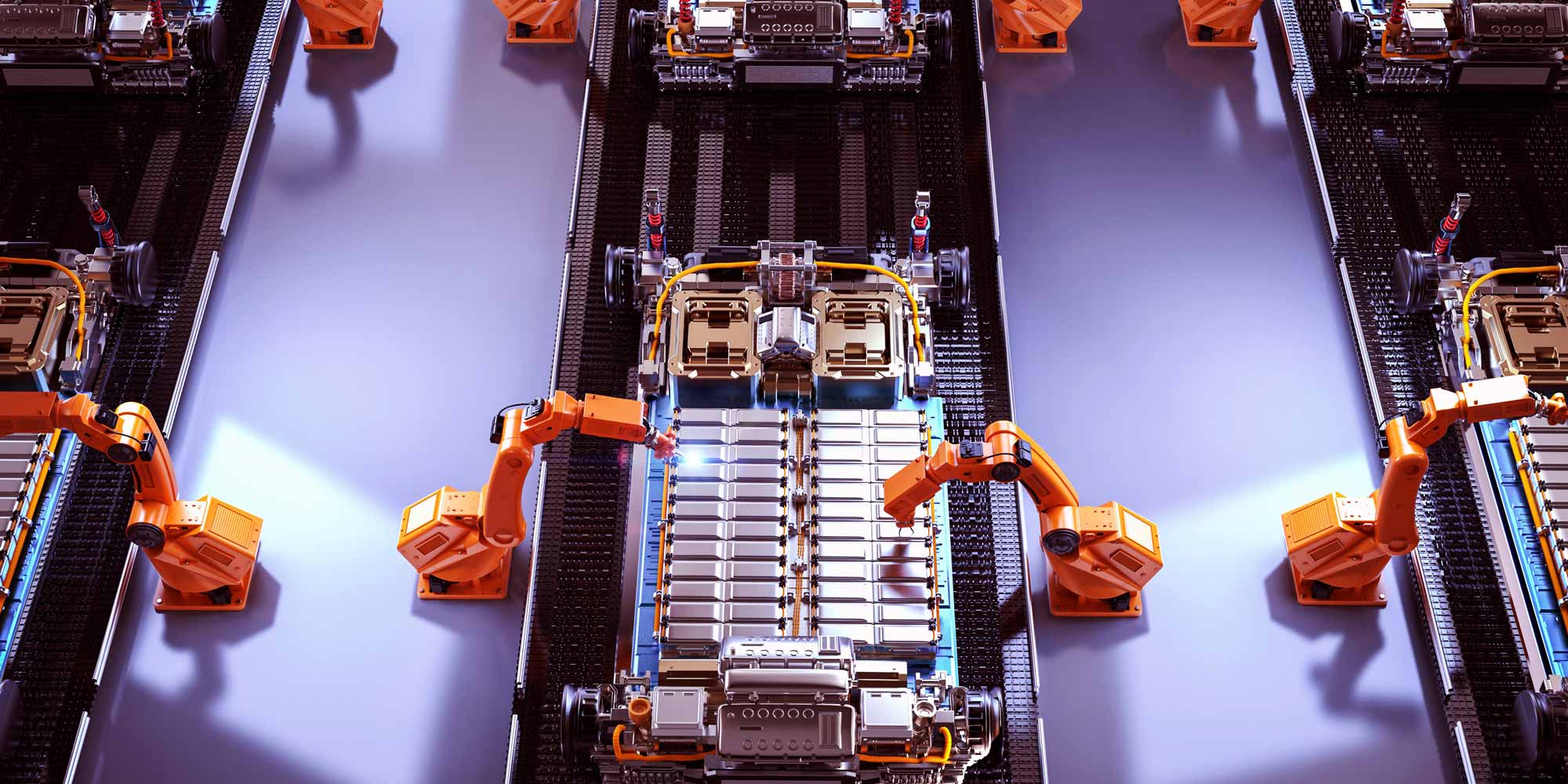

Understanding Trade Credit Insurance in the Battery Manufacturing Sector

In the rapidly evolving battery manufacturing industry, financial stability is paramount. Trade credit insurance emerges as a critical risk management tool, offering comprehensive protection against the unpredictable landscape of customer defaults, international trade complexities, and market volatility.

Key Takeaways

- Trade credit insurance protects manufacturers against customer payment defaults

- Essential for managing financial risks in battery manufacturing supply chains

- Enables confident expansion into new markets and customer segments

Unique Financial Challenges in Battery Manufacturing

Battery manufacturers face distinctive financial risks that make trade credit insurance not just beneficial, but often essential:

Primary Financial Risks

- High Capital Investment: Battery production requires significant upfront investments in technology, research, and manufacturing infrastructure.

- Complex Supply Chains: Global sourcing of rare earth metals, lithium, and other critical components introduces multiple financial vulnerabilities.

- Technological Volatility: Rapid technological changes can quickly devalue inventory and impact customer creditworthiness.

- International Market Dynamics: Fluctuating demand in electric vehicle, renewable energy, and consumer electronics sectors create unpredictable revenue streams.

What is Trade Credit Insurance?

Trade credit insurance is a specialized financial protection mechanism that safeguards businesses against losses from customer non-payment. For battery manufacturers, this means:

Comprehensive Coverage

- Protection against commercial and political risks

- Coverage for domestic and international sales

- Mitigation of potential bad debt losses

- Enhanced financial planning and risk management

Specific Benefits for Battery Manufacturers

Trade credit insurance offers targeted advantages for battery manufacturing businesses:

Financial and Strategic Benefits

- Risk Assessment: Insurers provide detailed credit assessments of potential customers, helping manufacturers make informed sales decisions.

- Cash Flow Protection: Guaranteed compensation for unpaid invoices maintains stable financial operations.

- Expansion Confidence: Enables entry into new markets with reduced financial uncertainty.

- Improved Borrowing Capacity: Demonstrates financial prudence to lenders and investors.

- Global Market Navigation: Specialized coverage for international trade complexities.

Types of Trade Credit Insurance Coverage

Battery manufacturers can choose from various coverage types tailored to their specific operational needs:

Coverage Options

- Whole Turnover Policy: Comprehensive coverage for entire sales portfolio

- Specific Buyer Policy: Protection for high-risk or high-value customer accounts

- Single Buyer Policy: Targeted coverage for individual critical customers

- Export Credit Policy: Specialized protection for international sales

Risk Assessment in Battery Manufacturing Trade Credit Insurance

Insurers evaluate multiple factors when providing trade credit insurance for battery manufacturers:

Key Evaluation Parameters

- Customer financial stability

- Market sector performance

- Historical payment behaviors

- Geopolitical and economic risks

- Technological market trends

- Supply chain resilience

Understanding Trade Credit Insurance Costs

Premium calculations for battery manufacturers involve complex risk modeling:

Premium Determination Factors

- Annual sales volume

- Customer credit profiles

- Geographic sales distribution

- Historical claim rates

- Industry-specific risk factors

Typical premium rates range from 0.5% to 1.5% of insured turnover, varying based on specific risk profiles.

Implementing Trade Credit Insurance: A Strategic Approach

Successful trade credit insurance integration requires a methodical approach:

Recommended Implementation Process

- Conduct comprehensive internal financial review

- Analyze customer credit histories

- Select appropriate insurance provider

- Develop robust credit management procedures

- Regular policy review and adjustment

Potential Pitfalls and How to Avoid Them

Battery manufacturers should be aware of potential trade credit insurance challenges:

Common Mistakes and Solutions

- Underestimating Coverage Needs: Conduct thorough risk assessments

- Ignoring Policy Details: Carefully review exclusions and terms

- Inconsistent Documentation: Maintain meticulous financial records

- Delayed Claim Reporting: Establish prompt communication protocols

Future of Trade Credit Insurance in Battery Manufacturing

Emerging trends indicate increasing sophistication in trade credit insurance for battery manufacturers:

Anticipated Developments

- AI-driven risk assessment

- Real-time credit monitoring

- Blockchain-enabled transparency

- Climate risk integration

Conclusion: Strategic Financial Protection

Trade credit insurance represents more than just a financial safeguard—it's a strategic tool enabling battery manufacturers to navigate complex market landscapes with confidence and resilience.

0330 127 2333

0330 127 2333