Small-Scale Battery Manufacturing Insurance: Complete Guide for UK Producers

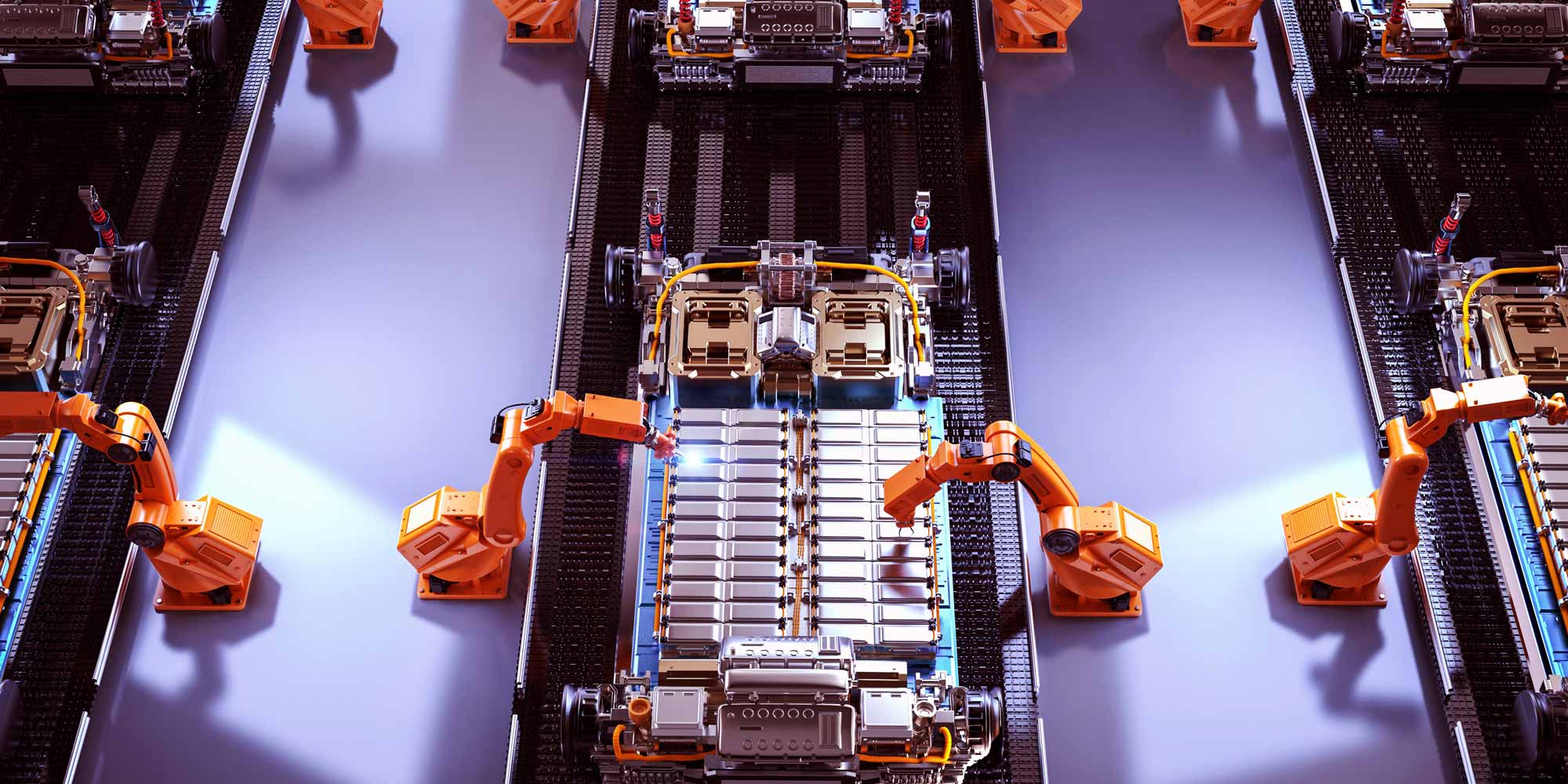

The battery manufacturing sector is experiencing unprecedented growth as the world transitions toward renewable energy and electric vehicles. Small-scale battery manufacturers play a crucial role in this transformation, producing batteries for everything from consumer electronics to energy storage systems. However, the production of batteries involves significant risks, from chemical handling and fire hazards to product liability and environmental concerns.

For small-scale battery manufacturers in the UK, securing comprehensive insurance coverage is not just a regulatory requirement but a fundamental business necessity. The unique combination of chemical processes, electrical systems, precision manufacturing, and product safety concerns creates a complex risk profile that demands specialized insurance solutions. This guide explores the essential insurance coverage needed to protect your battery manufacturing operation from financial loss and ensure business continuity.

Understanding the Risks in Battery Manufacturing

Battery manufacturing presents a distinctive set of hazards that differentiate it from other manufacturing sectors. The production process involves handling volatile chemicals, managing thermal risks, operating specialized equipment, and ensuring product quality that directly impacts end-user safety.

Chemical and Material Hazards

Battery production requires the use of hazardous materials including lithium compounds, electrolytes, solvents, and various chemical additives. These substances pose risks of chemical burns, toxic exposure, environmental contamination, and reactive incidents. Small-scale manufacturers often handle these materials in more confined spaces, potentially increasing exposure risks for workers and the facility itself.

Fire and Thermal Runaway Risks

Lithium-ion batteries, in particular, present significant fire risks during manufacturing, testing, and storage. Thermal runaway events can occur when batteries overheat, leading to fires that are difficult to extinguish and can spread rapidly through manufacturing facilities. The presence of flammable electrolytes and the energy density of battery materials make fire prevention and suppression critical concerns.

Equipment and Machinery Risks

Battery manufacturing requires specialized equipment including coating machines, calendering systems, electrode assembly equipment, formation and testing apparatus, and environmental control systems. Equipment breakdown can halt production, damage work-in-progress, and result in significant financial losses. The precision nature of battery manufacturing means even minor equipment malfunctions can compromise product quality.

Product Liability Exposure

Defective batteries can cause serious harm to end users, including fires, explosions, chemical leaks, and device damage. Small-scale manufacturers supplying batteries to other businesses or consumers face substantial product liability exposure. A single batch of defective batteries could result in widespread recalls, legal claims, and reputational damage that threatens business viability.

Environmental and Regulatory Compliance

Battery manufacturing is subject to stringent environmental regulations governing chemical storage, waste disposal, air quality, and water discharge. Non-compliance can result in fines, cleanup costs, and operational shutdowns. The disposal and recycling of battery materials and manufacturing waste require careful management to prevent environmental contamination.

Essential Insurance Coverage for Battery Manufacturers

Property and Buildings Insurance

Comprehensive property insurance protects your manufacturing facility, including the building structure, leasehold improvements, and fixed installations. For battery manufacturers, this coverage must account for the increased fire risk and potential for significant property damage from chemical incidents. Standard property policies may exclude or limit coverage for chemical-related damage, making it essential to secure specialized coverage that addresses battery manufacturing risks.

Your property insurance should cover fire damage, explosion, chemical spills, water damage from sprinkler systems, and damage to environmental control systems critical for battery production. Consider replacement cost coverage rather than actual cash value to ensure you can fully rebuild and re-equip your facility following a major loss.

Equipment Breakdown and Machinery Insurance

Specialized manufacturing equipment represents a significant capital investment for small-scale battery producers. Equipment breakdown insurance covers the cost of repairing or replacing damaged machinery, as well as the business interruption losses that result from production downtime. This coverage should extend to coating equipment, mixing systems, assembly machinery, formation cyclers, testing equipment, and environmental control systems.

Given the specialized nature of battery manufacturing equipment, policies should include coverage for expedited shipping of replacement parts, temporary equipment rental, and the cost of expert technicians needed for repairs. Some policies also cover the cost of spoiled materials and work-in-progress damaged due to equipment failure.

Stock and Raw Materials Insurance

Battery manufacturers maintain inventories of expensive raw materials including lithium compounds, cathode and anode materials, electrolytes, separators, and packaging components. Stock insurance protects these materials, work-in-progress, and finished goods from fire, theft, water damage, and other perils. For battery manufacturers, this coverage must address the special handling and storage requirements of hazardous materials.

Consider coverage that includes contamination of raw materials, spoilage due to temperature control failure, and the cost of proper disposal of damaged hazardous materials. Finished battery inventory requires particular attention, as damaged batteries may pose disposal challenges and environmental liabilities.

Business Interruption Insurance

When fire, equipment breakdown, or other covered perils force you to suspend operations, business interruption insurance replaces lost income and covers continuing expenses. For battery manufacturers, even brief production stoppages can result in lost contracts, customer defection to competitors, and significant revenue loss.

Your business interruption coverage should include loss of gross profit, continuing fixed costs such as rent and salaries, and the cost of maintaining customer relationships during the interruption period. Extended coverage for supply chain disruption protects against losses when suppliers of critical battery materials or components experience their own operational problems. Consider contingent business interruption coverage that responds to disruptions at key customer facilities that would reduce demand for your batteries.

Product Liability Insurance

Product liability insurance is arguably the most critical coverage for battery manufacturers. This insurance protects against claims arising from defective batteries that cause injury, property damage, or financial loss to customers or end users. Coverage includes legal defense costs, settlements, and judgments, as well as the cost of product recalls.

Battery manufacturers should secure substantial product liability limits, potentially ranging from one million to ten million pounds or more, depending on production volume and distribution channels. The policy should cover gradual damage claims, not just sudden accidents, as battery defects may manifest over time. Ensure coverage extends to batteries sold internationally if you export products, and consider cyber liability extensions for smart batteries with connected features.

Public Liability Insurance

Public liability insurance protects against claims from third parties who suffer injury or property damage due to your manufacturing operations. For battery manufacturers, this includes visitors to your facility, neighboring businesses affected by chemical releases or fires, and contractors working on your premises. Coverage typically includes legal defense costs and compensation payments.

Given the hazardous nature of battery manufacturing, public liability limits of at least two million pounds are advisable, with higher limits for facilities in densely populated areas or those handling large quantities of hazardous materials. Ensure the policy covers pollution liability arising from sudden and accidental chemical releases.

Employers Liability Insurance

Employers liability insurance is a legal requirement in the UK for businesses with employees. This coverage protects against claims from workers who suffer injury or illness due to their employment. Battery manufacturing workers face exposure to hazardous chemicals, electrical systems, heavy machinery, and thermal hazards, making robust employers liability coverage essential.

Standard employers liability policies provide five million pounds of coverage, but manufacturers handling hazardous materials should consider higher limits. Ensure coverage extends to occupational illnesses that may develop over time from chemical exposure, as well as acute injuries from accidents. The policy should cover the cost of health and safety investigations and legal defense against Health and Safety Executive prosecutions.

Professional Indemnity Insurance

If your battery manufacturing business provides technical advice, custom battery design services, or consulting on battery applications, professional indemnity insurance protects against claims of negligent advice or design errors. This coverage is particularly relevant for manufacturers working with clients to develop specialized battery solutions for specific applications.

Professional indemnity policies cover legal defense costs, settlements, and judgments arising from alleged professional negligence. Coverage should extend to intellectual property infringement claims if you develop proprietary battery technologies or designs. Consider limits of at least one million pounds, with higher coverage for businesses providing extensive design and consulting services.

Environmental Liability Insurance

Battery manufacturing involves materials and processes that can cause environmental contamination. Environmental liability insurance covers the cost of pollution cleanup, third-party claims for environmental damage, and regulatory fines. This coverage is particularly important given the potential for soil and groundwater contamination from battery materials and manufacturing chemicals.

Policies should cover both sudden and gradual pollution events, as chemical releases may occur over time without immediate detection. Coverage should extend to off-site disposal locations if you transport hazardous waste to external facilities. Consider coverage for business interruption resulting from pollution events that require facility closure for cleanup.

Cyber Insurance

Modern battery manufacturing increasingly relies on digital systems for process control, quality management, inventory tracking, and customer data management. Cyber insurance protects against losses from data breaches, ransomware attacks, system failures, and cyber extortion. For manufacturers of smart batteries with connected features, cyber liability extends to product-related cyber incidents.

Coverage should include business interruption from cyber events, the cost of data recovery and system restoration, notification costs following data breaches, and liability for compromised customer information. If your manufacturing systems are connected to the internet or you maintain customer data, cyber insurance is an essential component of your risk management program.

Commercial Vehicle Insurance

If your business operates vehicles for material delivery, product distribution, or business travel, commercial vehicle insurance is required. For battery manufacturers, vehicle policies must account for the transportation of hazardous materials and finished batteries, which may require specialized coverage and compliance with dangerous goods regulations.

Ensure your vehicle insurance includes goods-in-transit coverage for batteries and raw materials, with limits reflecting the value of typical shipments. Coverage should extend to hired and non-owned vehicles if employees use personal vehicles for business purposes or you rent vehicles for temporary needs.

Risk Management Best Practices

Insurance provides financial protection, but effective risk management reduces the likelihood and severity of losses, potentially lowering insurance costs and improving business resilience.

Fire Prevention and Suppression

Implement comprehensive fire prevention measures including proper storage of flammable materials, regular equipment maintenance, hot work permits, and strict housekeeping standards. Install fire detection and suppression systems designed for lithium battery fires, including specialized extinguishing agents. Develop and regularly practice emergency response procedures for battery fires and thermal runaway events.

Chemical Safety Programs

Establish robust chemical management programs including proper storage in compatible containers, secondary containment systems, clear labeling, safety data sheet accessibility, and worker training on chemical hazards. Implement spill response procedures and maintain appropriate cleanup materials. Regular air quality monitoring helps detect chemical releases before they cause harm.

Quality Control Systems

Rigorous quality control throughout the manufacturing process reduces product liability exposure. Implement testing protocols at multiple production stages, maintain detailed batch records, establish clear quality standards, and investigate quality deviations promptly. Consider certification to relevant quality standards such as ISO 9001 to demonstrate systematic quality management.

Worker Training and Safety

Comprehensive worker training on chemical handling, equipment operation, emergency procedures, and personal protective equipment use is essential. Regular refresher training ensures workers maintain awareness of hazards and proper procedures. Encourage reporting of near-miss incidents and safety concerns to identify and address risks before they result in accidents.

Maintenance Programs

Preventive maintenance programs for manufacturing equipment, fire suppression systems, ventilation systems, and environmental controls reduce the risk of equipment failure and associated losses. Maintain detailed maintenance records and address identified issues promptly. Consider predictive maintenance technologies that identify potential equipment problems before failures occur.

Choosing the Right Insurance Provider

Not all insurance providers understand the unique risks of battery manufacturing. When selecting insurance coverage, consider providers with experience in chemical manufacturing, hazardous materials handling, or battery production specifically. Specialized brokers can help identify insurers willing to provide comprehensive coverage at competitive rates.

Request quotes from multiple providers to compare coverage terms, exclusions, and pricing. Pay particular attention to policy exclusions, as standard manufacturing policies may exclude or severely limit coverage for chemical-related incidents, pollution, and product liability. Ensure you understand coverage triggers, deductibles, and claims procedures before binding coverage.

Consider the financial strength of insurance providers, as you need confidence they can pay claims even after major industry losses. Review insurer ratings from agencies such as AM Best or Standard and Poor's. Ask about claims handling procedures and typical response times, as prompt claims settlement is critical for business recovery following losses.

Factors Affecting Insurance Costs

Insurance premiums for battery manufacturers vary based on numerous factors including production volume, battery chemistry, facility size and construction, fire protection systems, loss history, and risk management practices. Small-scale manufacturers may benefit from lower premiums than large facilities, but face challenges in accessing specialized coverage.

Implementing strong risk management practices can significantly reduce insurance costs. Insurers offer premium discounts for facilities with sprinkler systems, chemical containment systems, comprehensive safety programs, and quality certifications. Maintaining a clean loss history demonstrates effective risk management and supports favorable premium negotiations.

Deductible selection impacts premium costs, with higher deductibles reducing premiums but increasing out-of-pocket costs following losses. Consider your financial capacity to absorb losses when selecting deductibles. Some manufacturers opt for higher deductibles on property coverage while maintaining lower deductibles on liability policies where claim costs can be unpredictable.

Regulatory and Compliance Considerations

Battery manufacturers must comply with numerous regulations including health and safety laws, environmental regulations, product safety standards, and transportation rules for hazardous materials. Insurance policies may require compliance with specific regulations as a condition of coverage, making regulatory adherence both a legal and insurance requirement.

The Health and Safety Executive enforces workplace safety regulations including the Control of Substances Hazardous to Health (COSHH) regulations relevant to battery manufacturing. The Environment Agency regulates environmental permits, waste management, and pollution prevention. Product safety regulations including the General Product Safety Regulations and battery-specific standards govern battery design and performance.

Maintain detailed records of regulatory compliance efforts including permits, inspections, training records, and testing results. These records support insurance claims and demonstrate due diligence in managing risks. Consider engaging compliance consultants to ensure your operations meet all applicable requirements.

Making Insurance Claims

When losses occur, prompt notification to your insurance provider is essential. Most policies require immediate notification of significant incidents, with formal claims submission within specified timeframes. Delay in reporting can jeopardize coverage.

Document losses thoroughly with photographs, videos, witness statements, and detailed descriptions of damaged property and circumstances of the incident. Preserve damaged equipment and materials for insurer inspection when safe to do so. Maintain records of business interruption losses including lost revenue, continuing expenses, and mitigation costs.

Cooperate fully with insurer investigations and provide requested documentation promptly. Consider engaging public adjusters or loss consultants for complex claims to ensure fair settlement. Understand your policy's dispute resolution procedures in case disagreements arise over coverage or claim valuation.

Protecting Your Battery Manufacturing Business

Battery manufacturing represents a critical sector in the transition toward renewable energy and electrification. While the opportunities are significant, the risks are equally substantial. Comprehensive insurance coverage is not an expense but a strategic investment in your business's resilience and long-term success.

The complex risk landscape of battery manufacturing demands a holistic approach to insurance and risk management. No single policy can address all potential challenges. Instead, a carefully constructed insurance program combining multiple specialized coverages provides the most robust protection.

Small-scale battery manufacturers must view insurance as a dynamic tool that evolves with their business. As your production capabilities expand, your battery chemistries change, or you enter new markets, regularly review and update your insurance coverage. Annual insurance audits help ensure your protection remains aligned with your current operational risks.

Final Recommendations

- Work with insurance brokers specializing in manufacturing and chemical risks

- Implement comprehensive risk management programs

- Maintain meticulous documentation of safety procedures and quality control

- Stay updated on regulatory changes in battery manufacturing

- Invest in ongoing staff training and safety education

- Regularly review and update insurance coverage

0330 127 2333

0330 127 2333