Regulatory Compliance Insurance: Protecting Battery Manufacturers in a Complex Landscape

Introduction: The Critical Role of Regulatory Compliance in Battery Manufacturing

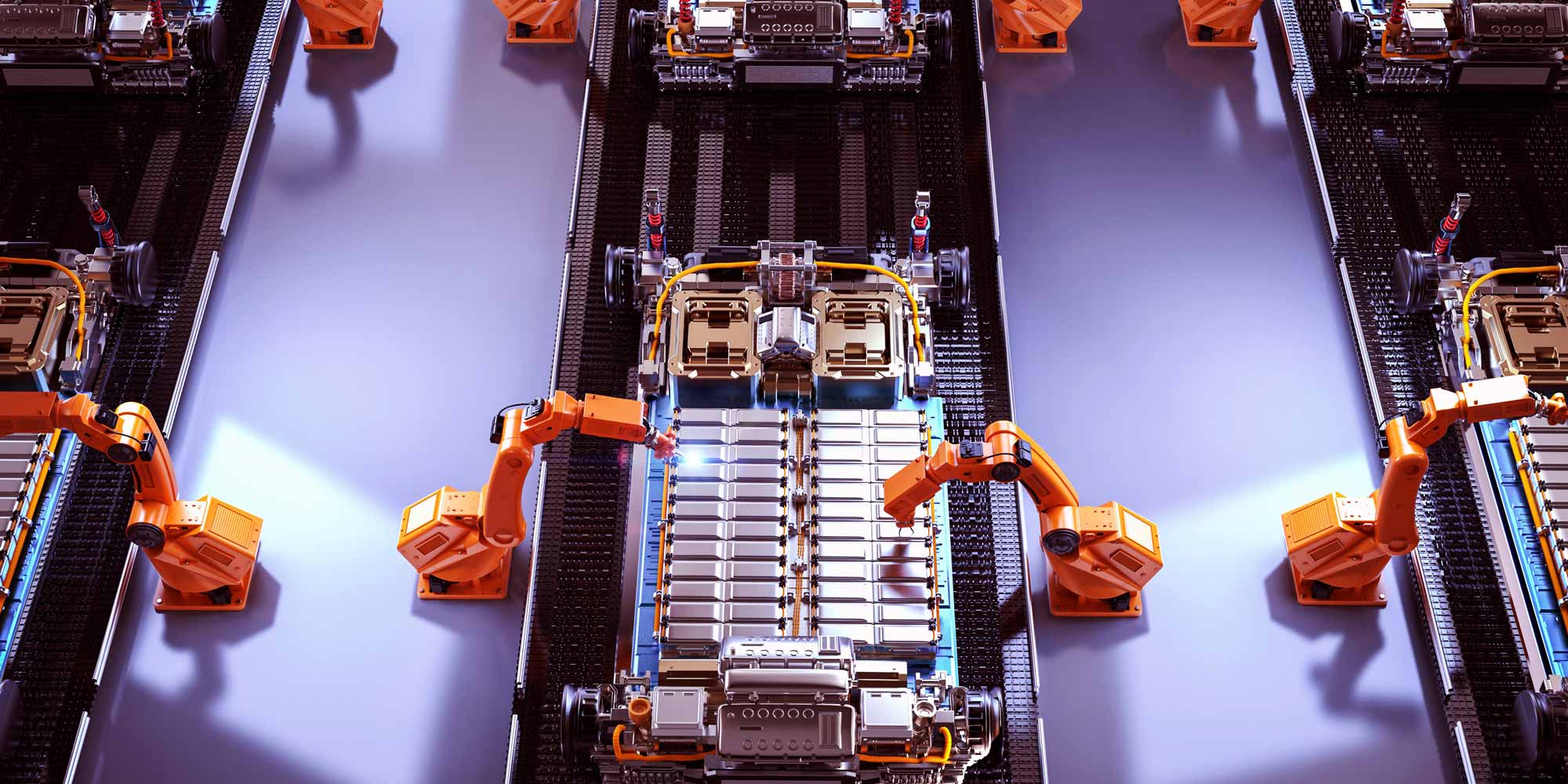

The battery manufacturing sector is experiencing unprecedented growth, driven by the global transition to electric vehicles, renewable energy storage, and advanced electronics. However, this rapid expansion comes with increasingly complex regulatory challenges that can expose manufacturers to significant financial and legal risks.

This comprehensive guide explores the intricate world of regulatory compliance insurance for battery manufacturers, providing insights into the essential protections needed to navigate this dynamic industry successfully.

Understanding the Regulatory Landscape

Global and Regional Regulatory Frameworks

Battery manufacturers operate in a complex regulatory environment that spans multiple jurisdictions and includes various critical compliance areas:

- Environmental Regulations: Strict guidelines on material sourcing, manufacturing processes, waste management, and carbon footprint

- Safety Standards: Comprehensive requirements for product safety, testing, and quality control

- Chemical and Hazardous Material Handling: Stringent rules governing the use, storage, and transportation of potentially dangerous materials

- International Trade Compliance: Export controls, sanctions, and cross-border manufacturing regulations

- Workplace Safety: Occupational health and safety standards specific to battery manufacturing

Key Regulatory Bodies and Their Impact

Manufacturers must comply with regulations from multiple agencies, including:

- European Chemicals Agency (ECHA)

- United States Environmental Protection Agency (EPA)

- Occupational Safety and Health Administration (OSHA)

- International Electrotechnical Commission (IEC)

- International Organization for Standardization (ISO)

Compliance Risks in Battery Manufacturing

Financial and Legal Exposures

Non-compliance can result in severe consequences, including:

- Substantial financial penalties

- Legal litigation

- Product recalls

- Reputational damage

- Potential business interruption

- Loss of manufacturing licenses

Emerging Risk Areas

The battery manufacturing sector faces unique and evolving compliance challenges:

- Rapidly changing battery chemistry technologies

- Increasing sustainability requirements

- Growing emphasis on circular economy principles

- Enhanced traceability and supply chain transparency

- Stricter environmental impact assessments

Comprehensive Insurance Solutions for Regulatory Compliance

Professional Indemnity Insurance

Professional indemnity insurance provides critical protection against claims arising from professional errors, negligence, or failure to meet regulatory standards. For battery manufacturers, this coverage is essential and typically includes:

- Legal defense costs

- Compensation for regulatory non-compliance claims

- Protection against design and specification errors

- Coverage for intellectual property disputes

Product Liability Insurance

Given the potential risks associated with battery manufacturing, product liability insurance is crucial. This coverage protects manufacturers against claims related to:

- Manufacturing defects

- Design failures

- Inadequate warnings or instructions

- Battery performance and safety issues

- Potential environmental contamination

Environmental Liability Insurance

Specialized environmental liability insurance addresses the unique risks in battery manufacturing, covering:

- Pollution and contamination incidents

- Cleanup and remediation costs

- Third-party environmental damage claims

- Regulatory compliance penalties

- Emergency response expenses

Cyber Insurance for Regulatory Compliance

As battery manufacturing becomes increasingly digitized, cyber insurance plays a critical role in managing technological risks:

- Data breach protection

- Intellectual property theft coverage

- Regulatory investigation support

- Business interruption from cyber incidents

- Technology errors and omissions protection

Proactive Risk Management Strategies

Comprehensive Compliance Frameworks

Successful battery manufacturers implement robust risk management strategies that include:

- Regular compliance audits

- Continuous staff training

- Advanced tracking and documentation systems

- Proactive regulatory monitoring

- Investment in cutting-edge safety technologies

Insurance Portfolio Optimization

To maximize protection, manufacturers should:

- Conduct thorough risk assessments

- Work with specialized insurance brokers

- Regularly review and update coverage

- Implement comprehensive risk mitigation strategies

- Maintain detailed documentation

Future of Regulatory Compliance in Battery Manufacturing

The battery manufacturing sector is poised for significant transformation, with regulatory compliance becoming increasingly sophisticated. Anticipated developments include:

- More stringent global environmental standards

- Enhanced traceability requirements

- Greater emphasis on sustainable manufacturing

- Advanced technological solutions for compliance tracking

- Increased international collaboration on regulatory frameworks

Conclusion: Navigating Compliance with Confidence

Regulatory compliance insurance is no longer optional for battery manufacturers—it's a critical strategic imperative. By understanding the complex landscape, investing in comprehensive insurance solutions, and maintaining proactive risk management practices, manufacturers can protect their businesses, reputation, and future growth.

As the battery manufacturing sector continues to evolve, staying ahead of regulatory challenges will be key to sustainable success.

Frequently Asked Questions

Q1: How often should battery manufacturers review their regulatory compliance insurance?

Manufacturers should conduct comprehensive insurance reviews annually or whenever significant technological, regulatory, or business model changes occur.

Q2: Are small battery manufacturers also required to have comprehensive insurance?

Yes, even small manufacturers face significant risks and should have tailored insurance coverage proportionate to their operations.

Q3: How do international regulations impact insurance requirements?

International regulations can vary significantly, requiring manufacturers to have flexible, globally-aware insurance solutions that adapt to different jurisdictional requirements.

0330 127 2333

0330 127 2333