Medical Device Battery Manufacturing Insurance: Safeguarding Innovation and Compliance

Understanding the Critical Landscape of Medical Device Battery Manufacturing

In the rapidly evolving world of medical technology, battery manufacturers play a pivotal role in powering life-saving and life-enhancing devices. From implantable cardiac monitors to portable diagnostic equipment, the batteries you produce are not just components—they are critical lifelines. This comprehensive guide explores the intricate insurance landscape specifically designed for medical device battery manufacturers, highlighting the unique risks, regulatory challenges, and essential protection strategies.

Unique Risks in Medical Device Battery Manufacturing

Product Liability Risks

Medical device battery manufacturers face extraordinary product liability risks. A single battery malfunction could lead to:

- Patient injury or potential fatality

- Medical device failure during critical procedures

- Expensive medical interventions and legal claims

- Significant reputational damage

Technological and Performance Risks

The medical technology sector demands unprecedented precision. Battery performance risks include:

- Power capacity degradation

- Unexpected voltage fluctuations

- Temperature sensitivity

- Premature battery failure

Regulatory Compliance Challenges

Medical device battery manufacturers must navigate complex regulatory landscapes, including:

- FDA medical device regulations

- International medical device standards (ISO 13485)

- Strict quality management requirements

- Continuous documentation and traceability

Essential Insurance Coverage for Medical Device Battery Manufacturers

Professional Indemnity Insurance

Professional indemnity insurance protects against claims arising from professional errors, including:

- Design miscalculations

- Performance specification misrepresentations

- Technical consultation errors

- Intellectual property disputes

Product Liability Insurance

Critical for managing risks associated with battery performance and potential medical consequences:

- Covers legal defense costs

- Provides compensation for patient injuries

- Protects against manufacturing defect claims

- Supports recall expense management

Cyber Insurance

In an increasingly digital manufacturing environment, cyber insurance addresses:

- Data breach protection

- Intellectual property theft

- Manufacturing system disruption

- Ransomware and digital extortion

Business Interruption Insurance

Protects against financial losses from unexpected manufacturing disruptions, including:

- Equipment failure

- Supply chain interruptions

- Regulatory action suspensions

- Natural disaster impacts

Proactive Risk Mitigation Strategies

Quality Control Protocols

Implement rigorous quality control measures:

- Regular battery performance testing

- Comprehensive documentation

- Third-party certification processes

- Continuous staff training

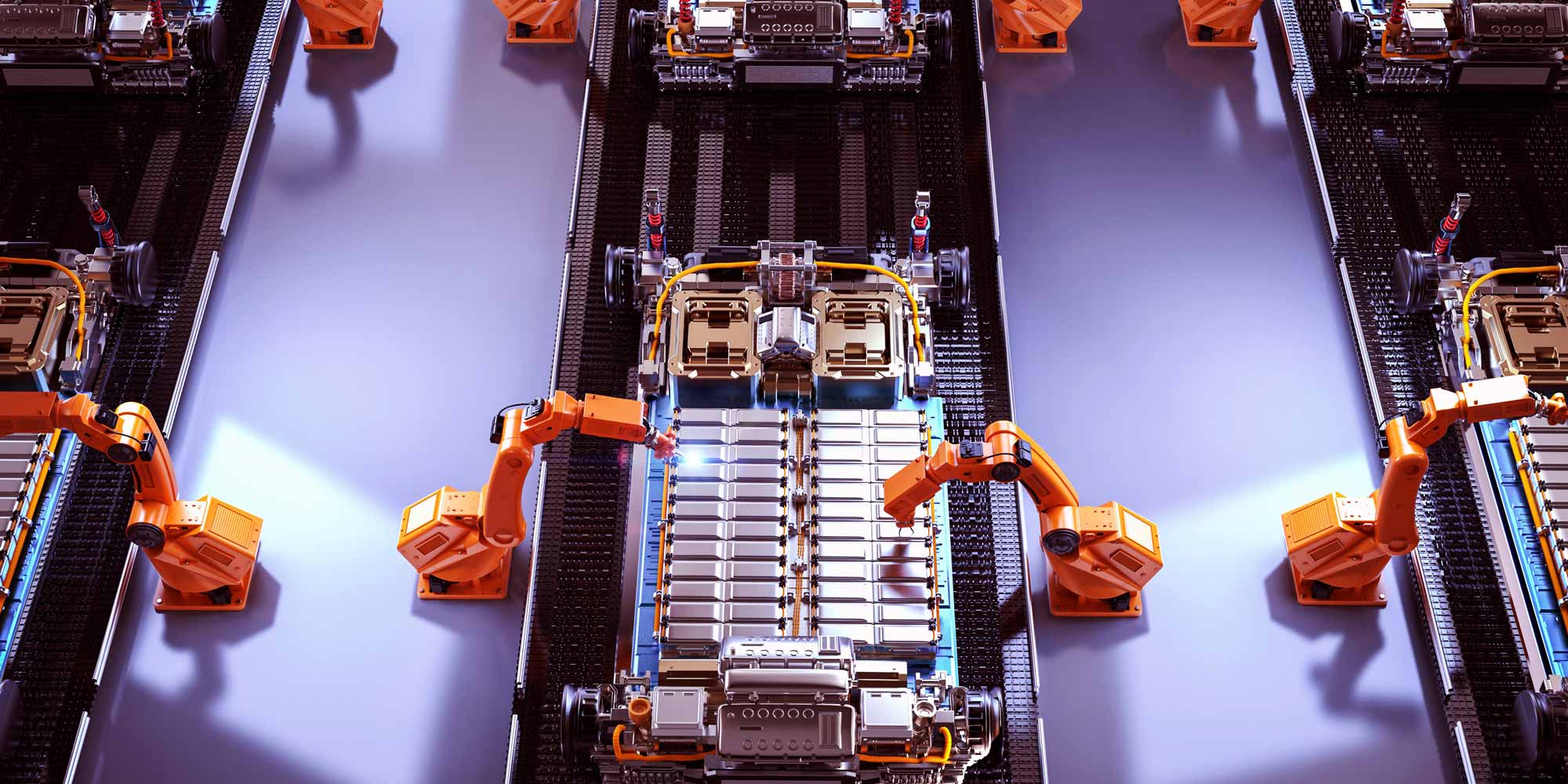

Technological Investment

Invest in advanced technologies to minimize risks:

- Advanced battery monitoring systems

- Real-time performance tracking

- Predictive maintenance technologies

- Automated quality assurance processes

Insurance Cost Factors for Medical Device Battery Manufacturers

Insurance premiums depend on multiple factors:

- Annual revenue

- Manufacturing complexity

- Historical claim records

- Risk management practices

- Technological sophistication

Securing Your Medical Device Battery Manufacturing Future

In the high-stakes world of medical device battery manufacturing, comprehensive insurance is not an expense—it's a critical investment in your company's sustainability, reputation, and ability to innovate. By understanding and proactively managing risks, you protect not just your business, but ultimately, the patients who depend on the life-saving devices you help power.

Frequently Asked Questions

How often should medical device battery manufacturers review their insurance coverage?

Annually, or whenever significant technological or regulatory changes occur.

Can insurance help with potential product recalls?

Yes, product liability and business interruption insurance can provide crucial financial support during recall scenarios.

Are international manufacturing standards important for insurance?

Absolutely. Compliance with international standards like ISO 13485 can positively impact insurance premiums and coverage terms.

0330 127 2333

0330 127 2333