Fire Risk Insurance for Battery Manufacturing Facilities: Protecting Your Business from Catastrophic Losses

Introduction: The Critical Importance of Fire Risk Management in Battery Manufacturing

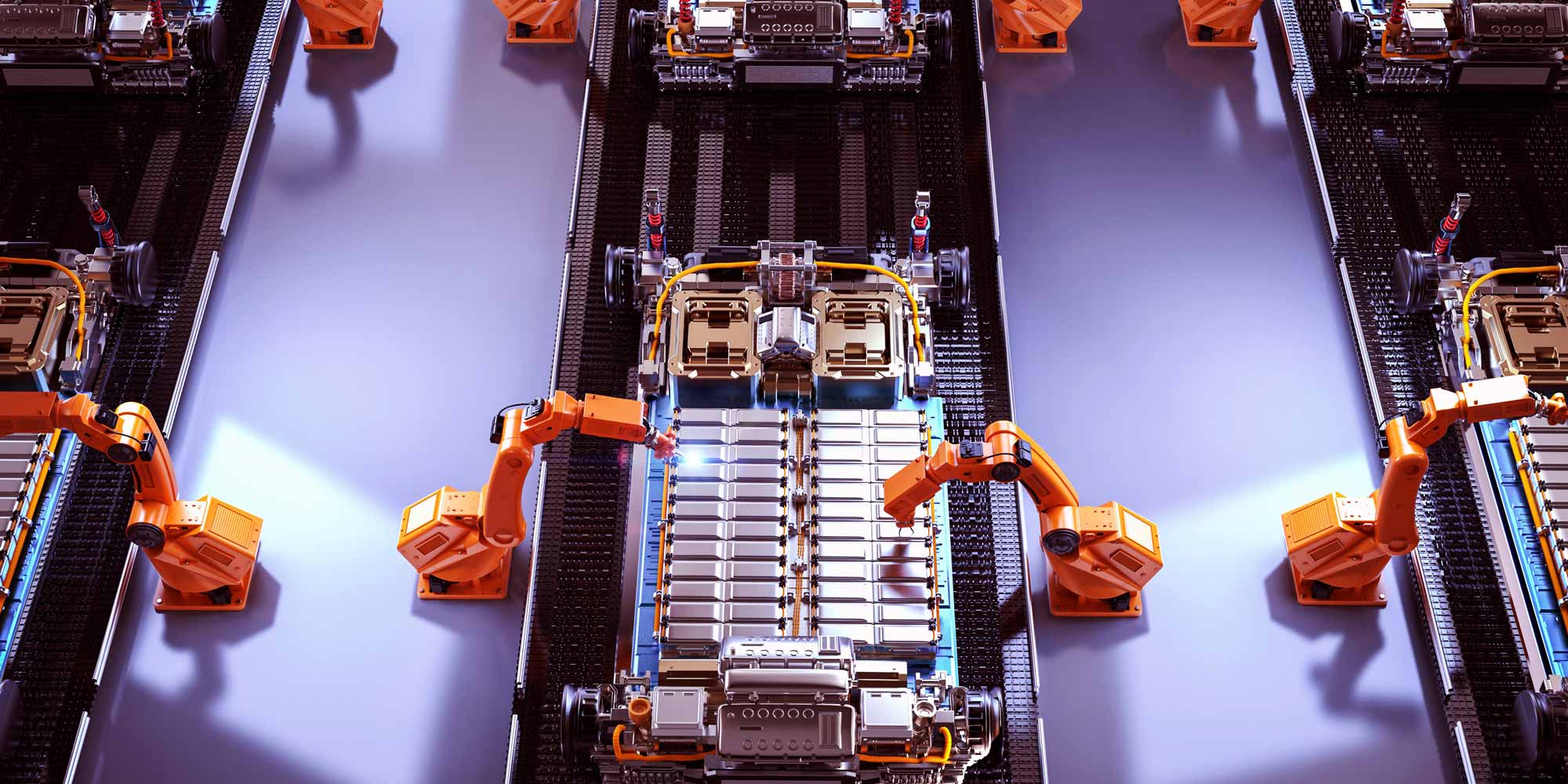

Battery manufacturing facilities represent a unique and complex risk landscape when it comes to fire protection and insurance. With the rapid growth of electric vehicle (EV) industries, renewable energy storage, and advanced electronics, battery production has become increasingly sophisticated—and potentially hazardous.

This comprehensive guide explores the intricate world of fire risk insurance for battery manufacturing facilities, providing crucial insights for business owners, risk managers, and insurance professionals.

Unique Fire Risks in Battery Manufacturing

Lithium-Ion Battery Specific Hazards

- Thermal Runaway: A critical risk where battery cells rapidly increase temperature, potentially leading to fire or explosion

- Chemical Instability: Electrolyte solutions and active materials can be highly flammable under specific conditions

- Short Circuit Potential: Manufacturing processes involving intricate electrical components increase fire risk

- Material Handling Challenges: Lithium and other reactive metals require specialized storage and transportation protocols

Manufacturing Environment Risks

- High-temperature manufacturing processes

- Presence of flammable solvents and chemicals

- Complex electrical systems and machinery

- Potential for dust explosions in processing areas

Comprehensive Fire Risk Insurance Coverage

Essential Insurance Components

- Property Insurance

Covers physical damage to manufacturing facilities, equipment, and infrastructure from fire-related incidents. Crucial considerations include:

- Full replacement cost coverage

- Coverage for specialized battery manufacturing equipment

- Business interruption protection

- Product Liability Insurance

Protects against potential claims arising from battery failures or fire incidents involving manufactured products. Key aspects include:

- Coverage for legal defense costs

- Compensation for damages caused by product defects

- Recall expense coverage

- Cyber Insurance

Modern battery manufacturing involves complex digital systems. Cyber insurance helps mitigate risks associated with:

- Potential system failures leading to fire risks

- Data breaches in manufacturing control systems

- Ransomware and digital infrastructure protection

- Environmental Liability Insurance

Addresses potential environmental contamination from battery manufacturing processes, including:

- Chemical spill cleanup

- Hazardous material disposal

- Regulatory compliance protection

Fire Risk Mitigation Strategies

Prevention and Safety Protocols

- Advanced Fire Suppression Systems

Implement specialized systems designed for battery manufacturing environments:

- Foam-based suppression for lithium-ion fires

- Inert gas flooding systems

- Automated detection and rapid response mechanisms

- Facility Design Considerations

Strategic facility layout to minimize fire spread and potential damage:

- Fire-resistant building materials

- Compartmentalization of high-risk areas

- Dedicated storage zones for reactive materials

- Employee Training Programs

Comprehensive safety training focusing on:

- Hazard recognition

- Emergency response protocols

- Proper handling of sensitive materials

Selecting the Right Fire Risk Insurance

Key Considerations for Battery Manufacturers

- Work with insurers specializing in advanced manufacturing risks

- Conduct thorough risk assessments

- Maintain detailed documentation of safety protocols

- Regularly update insurance coverage to match technological advancements

- Consider industry-specific endorsements and specialized coverage options

Financial Impact of Comprehensive Fire Risk Management

Investing in robust fire risk insurance and prevention strategies offers significant financial benefits:

- Reduced potential for catastrophic financial losses

- Lower insurance premiums through demonstrated risk management

- Enhanced investor and stakeholder confidence

- Business continuity and rapid recovery capabilities

Conclusion: Proactive Protection in a High-Stakes Industry

Battery manufacturing represents a critical sector driving technological innovation. By understanding and mitigating fire risks through comprehensive insurance and strategic safety protocols, businesses can protect their assets, employees, and future growth potential.

Remember: In battery manufacturing, fire risk management isn't just an insurance requirement—it's a fundamental business strategy.

0330 127 2333

0330 127 2333