Directors & Officers Insurance in Battery Manufacturing: Protecting Leadership in a High-Stakes Industry

Introduction: The Critical Role of D&O Insurance in Battery Manufacturing

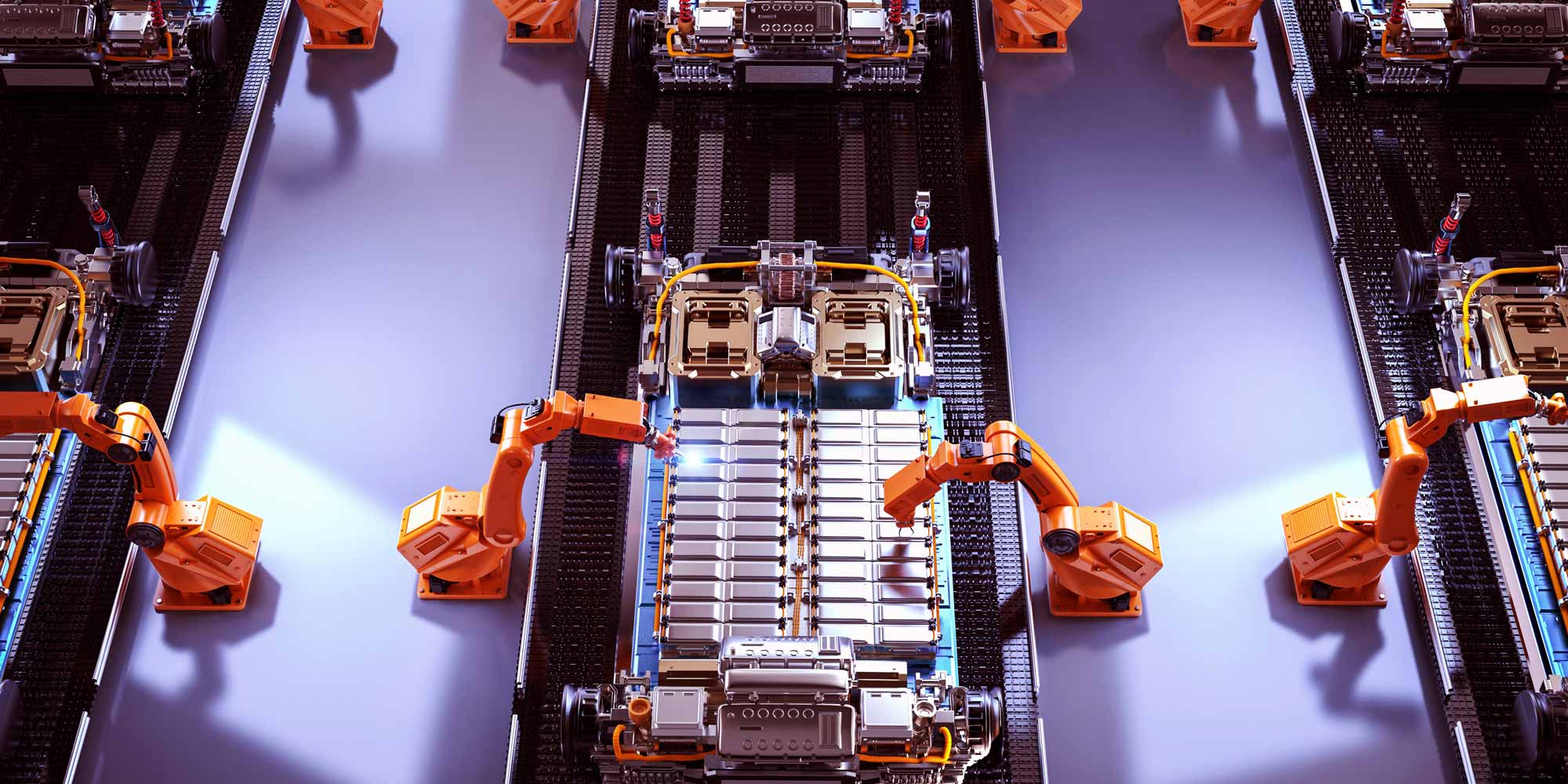

The battery manufacturing sector is experiencing unprecedented growth, driven by the global transition to electric vehicles, renewable energy storage, and advanced technological applications. With this rapid expansion comes increased complexity, regulatory scrutiny, and potential legal risks for company leadership. Directors & Officers (D&O) Insurance has never been more crucial for battery manufacturing companies.

Understanding the Unique Risk Landscape for Battery Manufacturing Leadership

Technological and Innovation Risks

Battery manufacturing sits at the intersection of cutting-edge technology, environmental sustainability, and complex supply chains. Directors and officers face unique challenges that can expose them to significant personal liability:

- Rapid technological obsolescence

- High-stakes research and development investments

- Complex intellectual property considerations

- Emerging regulatory environments

Environmental and Safety Compliance Risks

The battery manufacturing industry operates under intense environmental and safety regulations. Potential risks include:

- Chemical handling and disposal regulations

- Workplace safety standards

- Environmental protection compliance

- Potential toxic material exposure claims

What is Directors & Officers Insurance?

D&O Insurance provides financial protection for company leaders against claims arising from their management decisions. In battery manufacturing, this coverage is critical due to the industry's complex technological and regulatory landscape.

Key Coverage Components

- Side A Coverage: Protects individual directors and officers when the company cannot indemnify them

- Side B Coverage: Reimburses the company when it indemnifies directors and officers

- Side C Coverage: Provides entity coverage for the company itself

Specific Risks in Battery Manufacturing Requiring D&O Protection

Technological Investment and Performance Claims

Battery manufacturing involves substantial investments in research, development, and production infrastructure. Potential claims might arise from:

- Misrepresentation of technological capabilities

- Failure to meet performance specifications

- Inaccurate projections of battery efficiency or longevity

- Intellectual property disputes

Supply Chain and Procurement Risks

Complex global supply chains in battery manufacturing create additional exposure:

- Ethical sourcing challenges

- Raw material procurement controversies

- Geopolitical risks in international supply networks

- Potential sanctions or trade restriction violations

Environmental and Sustainability Claims

As sustainability becomes a critical corporate mandate, directors face increased scrutiny regarding:

- Carbon footprint management

- Waste reduction strategies

- Recycling and circular economy commitments

- Transparent environmental reporting

Calculating Appropriate D&O Insurance Limits for Battery Manufacturers

Determining appropriate coverage limits involves considering multiple factors:

- Company size and annual revenue

- Number of shareholders

- Complexity of technological portfolio

- Historical litigation trends in the sector

- International operational scope

Typical coverage limits for mid-sized battery manufacturers range from £1 million to £10 million, with larger enterprises potentially requiring £50 million or more in protection.

Emerging Trends Impacting D&O Insurance in Battery Manufacturing

ESG and Sustainability Reporting

Environmental, Social, and Governance (ESG) considerations are increasingly driving D&O insurance assessments. Insurers now evaluate:

- Transparent sustainability reporting

- Diversity in leadership

- Ethical supply chain management

- Long-term environmental strategy

Technological Risk Assessment

Insurers are developing more sophisticated models to assess technological risk in battery manufacturing, including:

- Advanced predictive analytics

- Real-time performance monitoring

- Comprehensive technology auditing

Choosing the Right D&O Insurance Partner

When selecting D&O insurance for a battery manufacturing company, consider insurers with:

- Deep understanding of technological manufacturing risks

- Experience in renewable energy and advanced manufacturing sectors

- Flexible policy structures

- Proactive risk management resources

Conclusion: D&O Insurance as a Strategic Asset

In the dynamic and complex world of battery manufacturing, Directors & Officers Insurance is more than a risk management tool—it's a strategic asset that enables leadership to innovate, invest, and drive technological advancement with confidence.

Frequently Asked Questions

Q1: Is D&O Insurance mandatory for battery manufacturing companies?

While not legally mandatory in all jurisdictions, it is highly recommended and often expected by investors, board members, and stakeholders.

Q2: How often should D&O insurance be reviewed?

Annually, or whenever significant changes occur in company structure, technological portfolio, or market conditions.

Q3: Does D&O Insurance cover criminal activities?

No, D&O Insurance typically does not cover intentional illegal actions or criminal misconduct.

0330 127 2333

0330 127 2333