Comprehensive Battery Manufacturing Insurance Guide: Protecting Your Operations in a High-Risk Industry

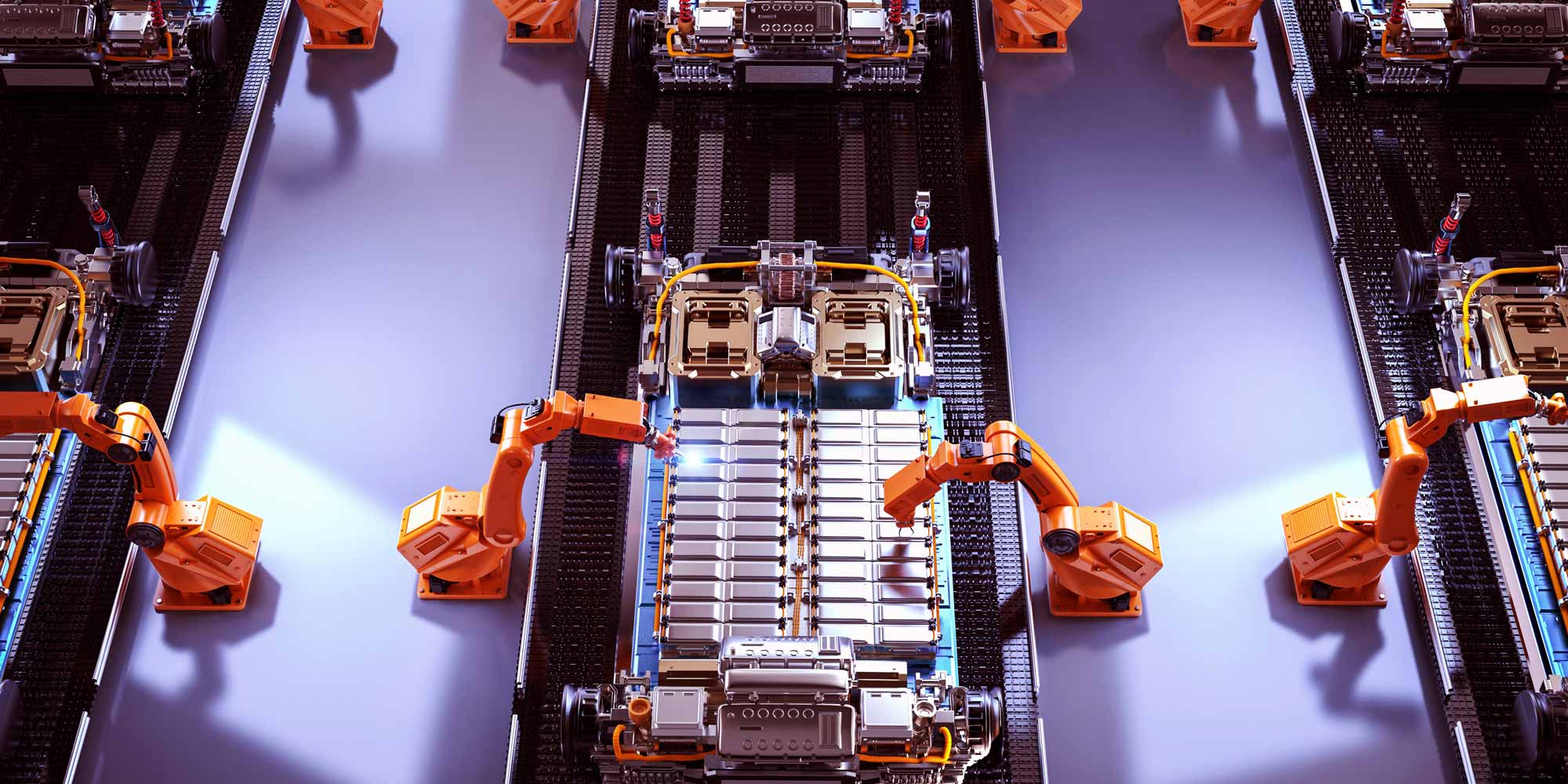

The battery manufacturing industry is experiencing unprecedented growth, driven by the global transition to electric vehicles, renewable energy storage, and portable electronics. However, this booming sector faces unique and significant risks that demand specialized insurance protection. From catastrophic fire hazards and chemical exposure to product liability claims and supply chain disruptions, battery manufacturers operate in one of the most challenging risk environments in modern manufacturing.

Whether you're producing lithium-ion batteries for electric vehicles, industrial batteries for energy storage systems, or consumer batteries for electronics, understanding and securing the right insurance coverage is essential for business continuity and financial protection. This comprehensive guide explores the critical insurance needs of battery manufacturers, the specific risks you face, and how to build a robust insurance portfolio that safeguards your operations, employees, and bottom line.

The Battery Manufacturing Landscape in the UK

The UK battery manufacturing sector is undergoing rapid expansion, with significant investment in gigafactories and advanced battery technology facilities. The government's commitment to phasing out petrol and diesel vehicles by 2030 has accelerated demand for domestic battery production capacity, creating both opportunities and challenges for manufacturers.

Battery manufacturing encompasses various segments including lithium-ion cells for electric vehicles, energy storage systems for renewable energy, industrial batteries for material handling equipment, and consumer batteries for electronics. Each segment presents distinct risk profiles that require tailored insurance solutions.

The sector faces intense scrutiny regarding safety standards, environmental compliance, and product quality. High-profile battery failures, thermal runaway incidents, and product recalls have heightened awareness of the catastrophic potential of battery manufacturing risks, making comprehensive insurance coverage not just advisable but essential for operational viability.

Critical Risks Facing Battery Manufacturers

Fire and Thermal Runaway

Fire risk represents the single greatest threat to battery manufacturing facilities. Thermal runaway—a chain reaction where battery cells overheat and ignite—can spread rapidly through production areas, causing catastrophic damage. Lithium-ion batteries are particularly susceptible, with fires that are difficult to extinguish and can reignite days after the initial incident.

Manufacturing processes involving flammable electrolytes, high-energy materials, and precision assembly create multiple ignition sources. A single defective cell or process error can trigger fires that destroy entire production lines, warehouses, and facilities. The financial impact extends beyond property damage to include business interruption, contamination of inventory, and potential total loss of operations.

Product Liability and Recall

Battery manufacturers face substantial product liability exposure. Defective batteries can cause fires, explosions, and injuries in consumer products, vehicles, and industrial applications. A single batch of faulty cells can affect thousands of end products, triggering massive recall campaigns.

Product liability claims can arise from manufacturing defects, design flaws, inadequate safety testing, or failure to warn about proper usage. The costs associated with product recalls—including retrieval, replacement, investigation, and reputational damage—can be financially devastating, particularly for smaller manufacturers supplying major automotive or electronics brands.

Environmental and Pollution Liability

Battery manufacturing involves hazardous materials including lithium, cobalt, nickel, manganese, and various chemical electrolytes. Spills, leaks, or improper disposal can cause significant environmental contamination affecting soil, groundwater, and air quality.

Environmental liability extends to cleanup costs, regulatory fines, third-party claims from affected properties, and long-term monitoring requirements. The increasing regulatory focus on environmental protection and the circular economy means manufacturers must demonstrate robust environmental management and maintain adequate pollution liability coverage.

Supply Chain Disruption

Battery manufacturing relies on complex global supply chains for raw materials, specialized components, and equipment. Disruptions from geopolitical events, natural disasters, supplier failures, or transportation issues can halt production and prevent fulfillment of customer contracts.

The concentration of critical materials in specific geographic regions creates vulnerability to supply shocks. Manufacturers face penalties for delayed deliveries, loss of customer contracts, and competitive disadvantage when unable to meet production commitments.

Equipment Breakdown and Technology Risks

Battery production requires sophisticated, expensive equipment including coating machines, assembly lines, formation and aging systems, and quality control technology. Equipment failures can halt production, damage work-in-progress, and require costly repairs or replacements.

The precision required in battery manufacturing means even minor equipment malfunctions can result in product defects, reduced yields, and quality control failures. Downtime costs accumulate rapidly in capital-intensive facilities with high fixed costs and customer delivery commitments.

Cyber Security and Intellectual Property

Battery manufacturers increasingly rely on digital systems for production control, quality management, and business operations. Cyber attacks can disrupt manufacturing processes, compromise proprietary formulations and processes, and expose sensitive customer data.

Intellectual property theft represents a significant threat, particularly for companies developing next-generation battery technologies. Industrial espionage, whether physical or digital, can undermine competitive advantage and years of research investment.

Employers Liability and Workplace Safety

Battery manufacturing environments present numerous workplace hazards including chemical exposure, electrical risks, heavy machinery, and fire dangers. Employees may suffer injuries from accidents, develop occupational illnesses from chemical exposure, or experience psychological trauma from workplace incidents.

Employers face legal obligations to provide safe working conditions and can be held liable for workplace injuries, occupational diseases, and safety violations. The costs of workplace incidents extend beyond immediate medical treatment to include lost productivity, regulatory investigations, and potential criminal prosecution for serious safety breaches.

Essential Insurance Coverage for Battery Manufacturers

Property and Material Damage Insurance

Comprehensive property insurance forms the foundation of protection for battery manufacturers. This coverage should protect buildings, production equipment, raw materials, work-in-progress, and finished goods against fire, explosion, natural disasters, and other perils.

Given the high fire risk, insurers typically require detailed risk assessments, robust fire suppression systems, and strict safety protocols. Coverage should reflect replacement cost values rather than depreciated values to ensure adequate rebuilding capacity. Consider including coverage for debris removal, temporary protection, and professional fees associated with reconstruction.

Business Interruption Insurance

Business interruption coverage protects against lost profits and continuing expenses when operations are disrupted by insured events. For battery manufacturers with high fixed costs and time-sensitive customer contracts, this coverage is critical for financial survival following major incidents.

Coverage should include gross profit protection, increased cost of working (to maintain operations at alternative facilities), and extended indemnity periods reflecting the time required to rebuild specialized manufacturing facilities. Consider contingent business interruption coverage for losses arising from supplier or customer disruptions.

Product Liability Insurance

Product liability coverage protects against claims arising from defective batteries causing injury, property damage, or economic loss. This insurance should provide adequate limits reflecting the potential scale of claims, particularly for manufacturers supplying automotive or consumer electronics markets.

Coverage should include defense costs, settlements, and judgments, as well as crisis management support for product recall situations. Ensure the policy covers products sold globally if you export batteries or components to international customers.

Product Recall Insurance

Dedicated product recall insurance covers the costs of retrieving, replacing, and disposing of defective batteries. This includes notification expenses, logistics, replacement products, investigation costs, and crisis management support.

Given the potential for widespread recalls affecting multiple product lines and customers, adequate recall coverage is essential. The policy should cover both voluntary recalls initiated by the manufacturer and mandatory recalls ordered by regulators.

Environmental and Pollution Liability

Environmental liability insurance covers cleanup costs, third-party claims, and regulatory fines arising from pollution incidents. This should include both sudden and gradual pollution events, as well as historical contamination discovered during operations.

Coverage should extend to transportation of hazardous materials, waste disposal, and environmental remediation. Consider including legal defense costs and coverage for regulatory investigations and penalties where insurable by law.

Equipment Breakdown Insurance

Equipment breakdown coverage protects against losses from mechanical or electrical failure of production equipment. This includes repair or replacement costs, damage to work-in-progress, and business interruption resulting from equipment failures.

For battery manufacturers relying on specialized, expensive equipment, this coverage provides essential protection against operational disruptions. Ensure coverage includes expediting expenses to speed repairs and minimize downtime.

Cyber Insurance

Cyber insurance protects against losses from data breaches, system failures, cyber attacks, and business interruption caused by digital incidents. Coverage should include incident response costs, data recovery, legal expenses, regulatory fines, and third-party liability for compromised customer data.

For manufacturers with integrated digital production systems, cyber coverage should address operational technology risks, not just information technology systems. Include coverage for intellectual property theft and funds transfer fraud.

Employers Liability Insurance

Employers liability insurance is legally required in the UK and protects against claims from employees injured or made ill through work activities. Coverage should provide adequate limits for serious injuries or occupational diseases with long latency periods.

Ensure coverage extends to all employment categories including temporary workers, contractors, and agency staff. Consider excess layers for catastrophic incidents affecting multiple employees.

Public Liability Insurance

Public liability coverage protects against claims from third parties for injury or property damage caused by your operations. This includes visitors to your facility, neighboring properties affected by incidents, and members of the public harmed by your activities.

Adequate limits are essential given the potential severity of battery-related incidents affecting surrounding areas. Coverage should include legal defense costs and crisis management support.

Directors and Officers Liability

D&O insurance protects company directors and officers against personal liability for management decisions. This coverage is increasingly important as stakeholders hold leadership accountable for safety failures, environmental incidents, and financial losses.

Coverage should include defense costs, settlements, and regulatory investigations. Consider employment practices liability coverage as an extension to address workplace discrimination and wrongful termination claims.

Risk Management Best Practices

Fire Prevention and Suppression

Implement comprehensive fire prevention measures including automatic sprinkler systems, early warning detection, thermal imaging, and specialized suppression systems designed for lithium battery fires. Maintain strict housekeeping standards, control ignition sources, and segregate high-risk processes.

Regular fire risk assessments, employee training, and emergency response drills are essential. Consider engaging specialist fire engineers to design protection systems appropriate for battery manufacturing risks.

Quality Control and Testing

Robust quality control processes reduce product liability exposure. Implement comprehensive testing protocols including electrical performance, thermal stability, mechanical integrity, and safety validation. Maintain detailed documentation of testing procedures and results.

Consider third-party certification and compliance with international standards such as UN 38.3, IEC 62133, and UL 1642. Traceability systems enabling rapid identification of affected batches are essential for managing potential recalls.

Environmental Management

Develop comprehensive environmental management systems addressing chemical storage, waste handling, spill prevention, and emergency response. Maintain appropriate permits, conduct regular environmental audits, and ensure compliance with all regulatory requirements.

Implement secondary containment for hazardous materials, maintain spill response equipment, and train employees in environmental protection procedures. Consider ISO 14001 certification to demonstrate environmental management commitment.

Supply Chain Resilience

Diversify suppliers for critical materials and components to reduce dependency on single sources. Maintain strategic inventory buffers for long-lead-time items and develop contingency plans for supply disruptions.

Conduct supplier risk assessments evaluating financial stability, operational resilience, and quality management. Consider supply chain insurance products addressing specific supplier or customer dependencies.

Cyber Security

Implement robust cyber security measures including network segmentation, access controls, regular security assessments, and employee training. Maintain offline backups of critical data and develop incident response plans.

Consider engaging cyber security specialists to assess vulnerabilities in both IT and operational technology systems. Regular penetration testing and security updates are essential for maintaining protection.

Working with Insurance Providers

Selecting the Right Insurer

Choose insurers with experience in battery manufacturing or related high-risk industries. Specialist insurers understand the unique risks and can provide tailored coverage rather than generic industrial policies.

Evaluate insurers based on financial strength, claims handling reputation, risk engineering support, and willingness to provide adequate limits. Consider working with specialist brokers who understand battery manufacturing risks and can access appropriate markets.

The Underwriting Process

Expect detailed underwriting scrutiny including facility inspections, process reviews, and risk management assessments. Provide comprehensive information about fire protection systems, quality control procedures, environmental management, and loss history.

Demonstrate commitment to risk management through documented procedures, employee training programs, and continuous improvement initiatives. Insurers reward strong risk management with better terms and pricing.

Managing Insurance Costs

While battery manufacturing insurance can be expensive, costs can be managed through effective risk management, appropriate deductibles, and strategic coverage structuring. Consider higher retentions for frequency risks while maintaining full coverage for catastrophic exposures.

Regular risk assessments, loss prevention investments, and claims management can demonstrate improving risk profiles to insurers. Multi-year agreements can provide premium stability and reduce annual renewal uncertainty.

Claims Management

Develop clear incident response procedures including immediate notification to insurers, evidence preservation, and mitigation of further losses. Maintain detailed documentation of incidents, response actions, and financial impacts.

Work proactively with insurers and loss adjusters to expedite claims resolution. Consider engaging specialist advisors for complex claims involving business interruption, product recall, or environmental liability.

Regulatory and Compliance Considerations

Battery manufacturers must comply with extensive regulations covering product safety, environmental protection, workplace health and safety, and transportation of dangerous goods. Regulatory compliance directly impacts insurance availability and pricing.

Key regulatory frameworks include the Battery Regulations 2024, REACH chemical regulations, Health and Safety at Work Act, Environmental Protection Act, and transportation regulations for dangerous goods. Non-compliance can void insurance coverage and result in substantial penalties.

Maintain current knowledge of evolving regulations, particularly regarding battery recycling, extended producer responsibility, and environmental sustainability. Consider regulatory compliance insurance to address potential violations and associated costs.

Future Trends in Battery Manufacturing Insurance

The battery manufacturing insurance market continues to evolve in response to technological advances, increasing production scale, and emerging risks. Solid-state batteries, advanced chemistries, and novel manufacturing processes will present new risk profiles requiring adapted insurance solutions.

Expect increased focus on sustainability, circular economy practices, and environmental social governance (ESG) factors in insurance underwriting. Manufacturers demonstrating strong ESG performance may access preferential insurance terms.

Technology-enabled risk management including IoT sensors, real-time monitoring, and predictive analytics will transform battery manufacturing insurance. Insurers will increasingly use data-driven approaches to assess and price risks, offering more dynamic and responsive coverage models.

The transition to electric vehicles and renewable energy storage will drive continued innovation in battery technology and associated insurance products. Manufacturers who invest in risk management, technological advancement, and sustainable practices will be best positioned to secure comprehensive, cost-effective insurance coverage.

Conclusion: Protecting Your Battery Manufacturing Future

Battery manufacturing represents a critical intersection of technological innovation, economic opportunity, and complex risk management. The right insurance strategy is not just a financial safeguard but a strategic asset that enables business growth, protects stakeholder value, and provides confidence to pursue ambitious manufacturing goals.

By understanding the unique risks inherent in battery production, implementing robust risk management practices, and developing a comprehensive insurance portfolio, manufacturers can navigate the challenges of this dynamic industry. Insurance is more than a compliance requirement—it's a strategic tool for resilience, innovation, and sustainable growth.

As the UK battery manufacturing sector continues to expand, driven by electric vehicle transition and renewable energy storage demands, proactive risk management and strategic insurance protection will be key differentiators for success.

0330 127 2333

0330 127 2333