Commercial Combined Insurance for Battery Production: Protecting Your Manufacturing Business

Introduction: The Critical Role of Insurance in Battery Production

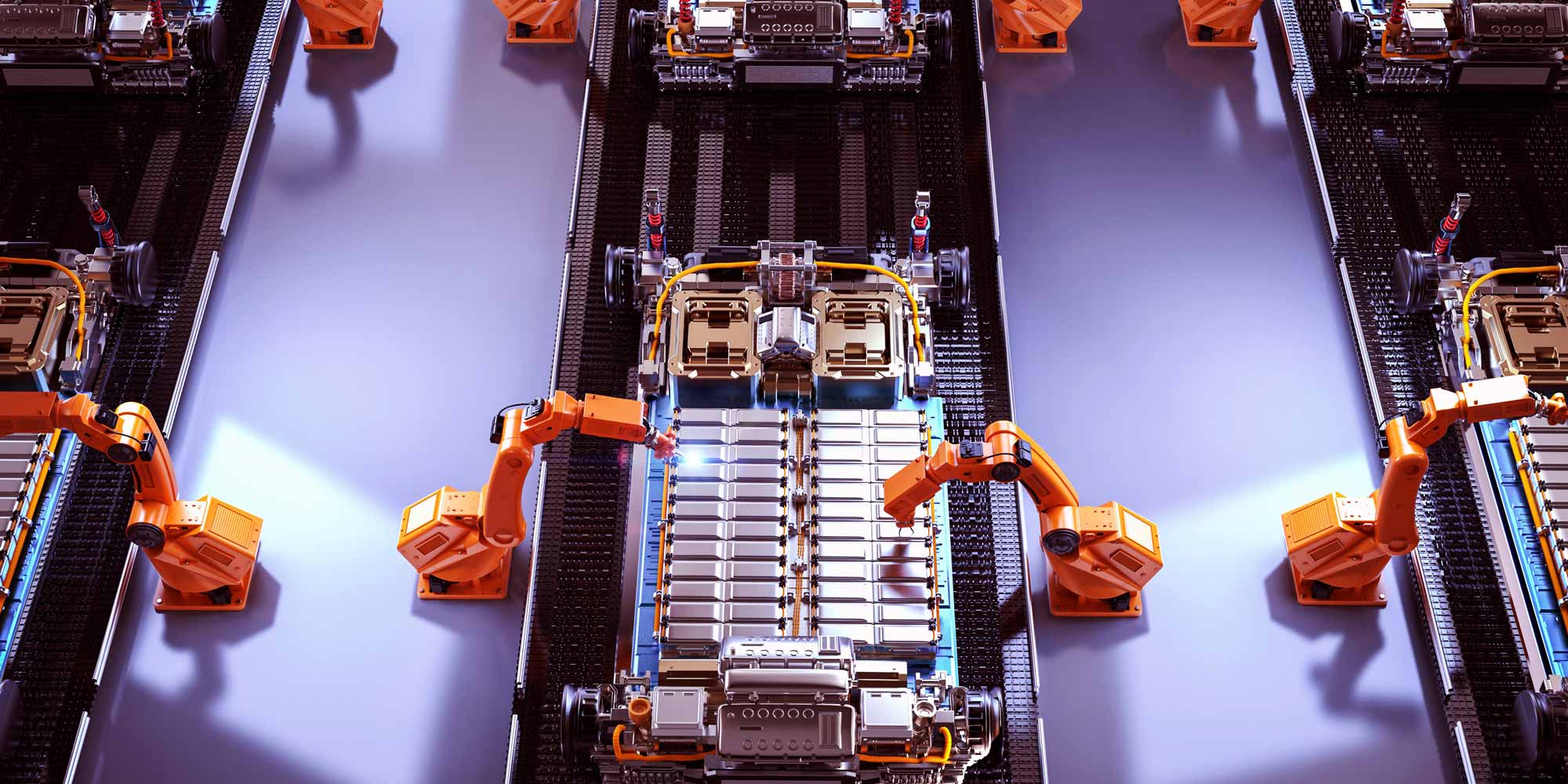

The battery production industry stands at the forefront of technological innovation, powering everything from electric vehicles to renewable energy storage. However, with cutting-edge manufacturing comes complex and significant risks that can potentially derail your business. Commercial Combined Insurance emerges as a critical shield, offering comprehensive protection tailored to the unique challenges of battery manufacturing.

Battery Production: An Industry in Transformation

Battery manufacturing is a high-stakes, rapidly evolving sector characterized by:

- Significant capital investments in advanced manufacturing equipment

- Complex chemical processes and potential environmental risks

- High-value raw materials and finished product inventories

- Stringent quality control and regulatory compliance requirements

- Emerging technologies and continuous innovation

Unique Risks in Battery Manufacturing

1. Property and Equipment Risks

Battery production facilities involve sophisticated, expensive equipment vulnerable to:

- Fire damage from chemical processes

- Electrical system failures

- Machinery breakdown

- Natural disaster impacts

2. Chemical and Environmental Risks

The battery production process involves hazardous materials that present significant risks:

- Chemical spills and contamination

- Potential environmental cleanup costs

- Health and safety incidents

- Regulatory compliance challenges

3. Product Liability Considerations

Battery manufacturers face substantial product liability risks, including:

- Potential battery performance failures

- Safety incidents related to battery malfunction

- Recalls and associated financial impacts

- Potential legal claims from end-users

What is Commercial Combined Insurance?

Commercial Combined Insurance is a comprehensive insurance solution that bundles multiple coverage types into a single, flexible policy. For battery production businesses, this typically includes:

- Property Insurance

- Employers' Liability Insurance

- Public Liability Insurance

- Product Liability Insurance

- Business Interruption Coverage

- Machinery Breakdown Insurance

Detailed Coverage Components for Battery Manufacturers

1. Property Insurance

Protects your physical assets, including:

- Manufacturing facilities

- Specialized battery production equipment

- Raw material inventories

- Finished product stockpiles

2. Employers' Liability Insurance

Critical for protecting your workforce in a high-risk manufacturing environment, covering:

- Workplace injury claims

- Occupational health incidents

- Chemical exposure risks

- Mandatory legal requirements

3. Public Liability Insurance

Shields your business from third-party claims arising from:

- Site visitor accidents

- Property damage during business operations

- Potential environmental incidents

- Supply chain interactions

4. Product Liability Insurance

Essential protection against claims resulting from:

- Battery performance failures

- Safety incidents

- Manufacturing defects

- Potential recalls

5. Business Interruption Coverage

Provides financial stability during unexpected disruptions, such as:

- Equipment breakdown

- Supply chain interruptions

- Regulatory shutdowns

- Major repair or replacement periods

Selecting the Right Commercial Combined Insurance

When choosing insurance for your battery production business, consider:

- Comprehensive risk assessment

- Accurate valuation of equipment and inventory

- Potential future growth and expansion

- Specific technological risks in battery manufacturing

- Regulatory compliance requirements

Factors Influencing Insurance Premiums

Insurance costs for battery production businesses depend on:

- Size of manufacturing operation

- Types of batteries produced

- Safety record and risk management practices

- Technological sophistication

- Geographic location and environmental risks

Proactive Risk Mitigation Strategies

Complement your Commercial Combined Insurance with:

- Robust safety training programs

- Regular equipment maintenance

- Comprehensive quality control processes

- Advanced environmental protection measures

- Continuous staff education on risk management

Conclusion: Insurance as a Strategic Business Asset

In the dynamic and high-stakes world of battery production, Commercial Combined Insurance is more than a regulatory requirement—it's a strategic business asset. By providing comprehensive protection across multiple risk domains, this insurance solution enables manufacturers to innovate, grow, and compete with confidence.

Frequently Asked Questions

Q1: How often should I review my Commercial Combined Insurance?

Annually, or whenever significant changes occur in your manufacturing process, technology, or business scale.

Q2: Are all battery production processes covered equally?

Coverage can vary based on specific manufacturing techniques, battery types, and associated risks. Always discuss detailed requirements with your insurance provider.

Q3: How do emerging battery technologies impact insurance?

New technologies might require specialized coverage. Insurers continually adapt policies to address innovative manufacturing processes.

0330 127 2333

0330 127 2333