Business Interruption Insurance for Battery Manufacturers: Complete Guide

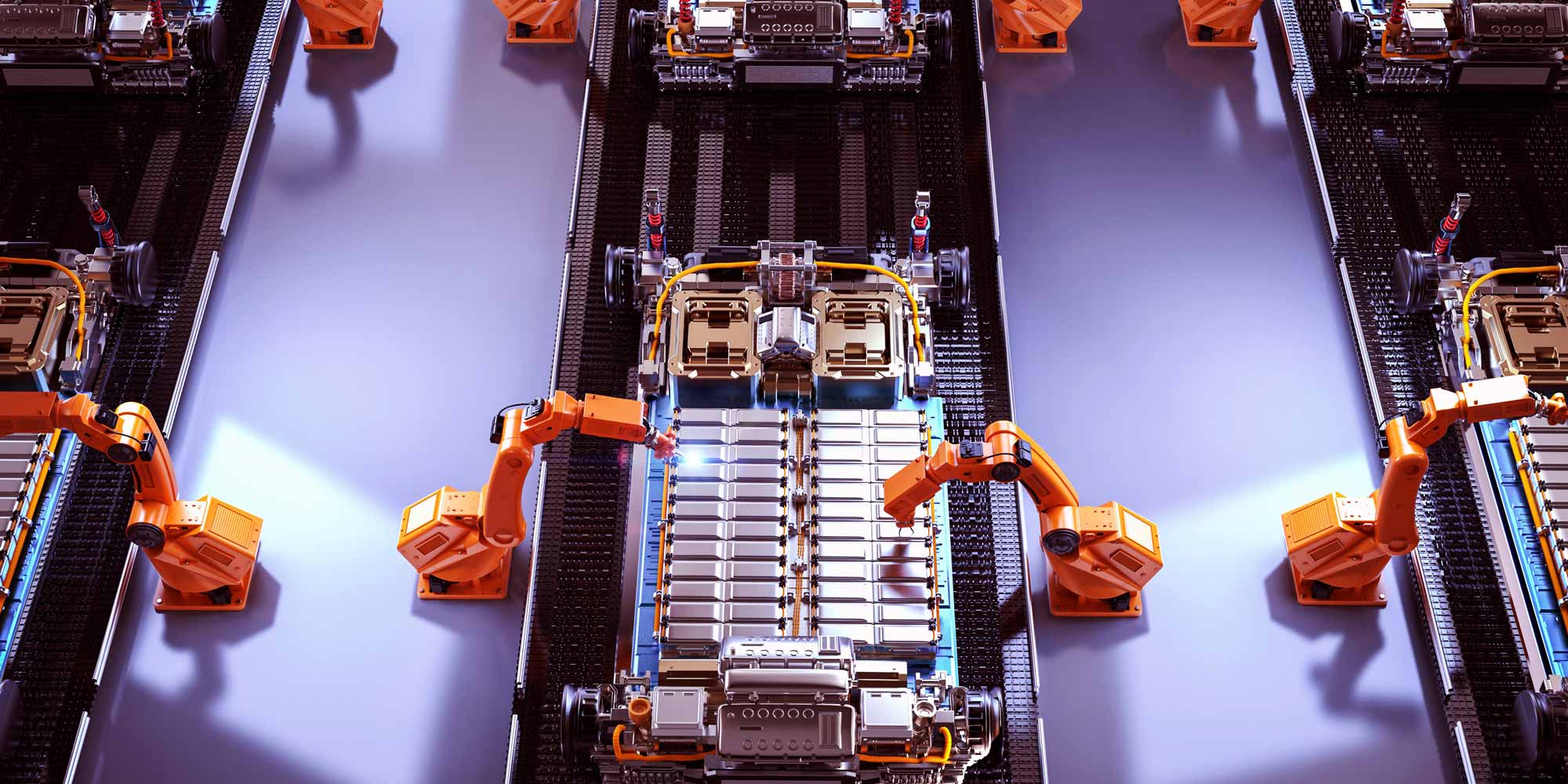

The battery manufacturing industry stands at the forefront of the global transition to renewable energy and electric mobility. From lithium-ion cells powering electric vehicles to energy storage systems supporting grid stability, battery manufacturers play a critical role in modern infrastructure. However, this sophisticated manufacturing environment faces unique operational risks that can halt production and devastate revenue streams. Business interruption insurance provides essential financial protection when unforeseen events force your battery manufacturing facility to cease or reduce operations.

Unlike standard property insurance that covers physical damage to buildings and equipment, business interruption insurance addresses the financial consequences of operational downtime. For battery manufacturers operating capital-intensive facilities with complex supply chains, specialized equipment, and strict quality control requirements, even brief interruptions can result in substantial financial losses. This comprehensive guide explores how business interruption insurance protects battery manufacturing operations, what coverage includes, and how to ensure your policy adequately safeguards your business.

What Is Business Interruption Insurance for Battery Manufacturers?

Business interruption insurance, also known as business income insurance, compensates battery manufacturers for income lost during periods when operations are suspended or reduced due to covered perils. This coverage bridges the gap between when a disruptive event occurs and when your manufacturing facility returns to normal production capacity.

For battery manufacturers, this insurance typically covers:

- Lost Net Profit: The profit you would have earned had the interruption not occurred, calculated based on historical financial performance and projected revenue

- Continuing Fixed Costs: Ongoing expenses that continue despite halted production, including lease or mortgage payments, insurance premiums, utility base charges, and equipment financing

- Employee Wages: Salaries for key personnel you retain during the interruption period to facilitate recovery and restart operations

- Temporary Relocation Costs: Expenses associated with moving operations to a temporary facility to minimize downtime

- Extra Expenses: Additional costs incurred to reduce the interruption period, such as expedited equipment repairs, overtime labor, or temporary equipment rental

- Debt Obligations: Loan payments and financial commitments that remain due regardless of production status

The coverage period typically begins after a waiting period (usually 24-72 hours) following the triggering event and continues until operations return to the condition that would have existed had no loss occurred, or until the policy limit is exhausted.

Unique Risks Facing Battery Manufacturing Operations

Battery manufacturing facilities face distinctive operational vulnerabilities that make business interruption insurance particularly valuable:

Fire and Thermal Events

Battery manufacturing involves handling highly reactive materials and energy-dense products. Lithium-ion battery production presents fire risks during electrode coating, cell assembly, and formation charging processes. Thermal runaway events, though rare, can cause significant facility damage and extended shutdowns while safety investigations are conducted and equipment is replaced or recertified.

Equipment Breakdown

Battery manufacturing relies on specialized, expensive equipment including coating machines, calendaring systems, winding or stacking equipment, electrolyte filling stations, formation cyclers, and automated assembly lines. Breakdown of critical machinery can halt entire production lines. Replacement parts for specialized battery manufacturing equipment often have long lead times, potentially extending interruption periods from weeks to months.

Contamination Events

Battery manufacturing requires cleanroom or controlled-atmosphere environments to prevent contamination that compromises product quality and safety. Contamination incidents may require extensive cleaning, equipment recalibration, and product testing before production can resume. Even minor contamination can necessitate scrapping entire production batches and thorough facility decontamination.

Supply Chain Disruptions

Battery manufacturers depend on specialized raw materials including lithium compounds, cobalt, nickel, graphite, electrolyte solutions, and separator films. Disruption to suppliers of these critical materials can force production shutdowns. Many materials come from geographically concentrated sources, creating vulnerability to regional disruptions.

Utility Failures

Battery manufacturing processes require stable electrical power, process water, compressed gases, and climate control. Extended power outages can damage in-process materials, disrupt formation charging cycles, and compromise environmental controls. Voltage fluctuations or power quality issues can damage sensitive manufacturing equipment.

Regulatory and Compliance Issues

Battery manufacturers must comply with stringent safety, environmental, and quality standards. Regulatory violations or failed audits can result in production suspensions until corrective actions are implemented and verified. Product recalls due to safety concerns can halt production while root causes are investigated and addressed.

Cyber Incidents

Modern battery manufacturing facilities rely heavily on automated systems, industrial control systems, and enterprise resource planning software. Cyberattacks, including ransomware, can disable production systems, compromise product quality data, or prevent access to critical manufacturing execution systems.

Key Coverage Components for Battery Manufacturers

Direct Business Interruption

This core coverage responds when physical damage to your manufacturing facility from a covered peril forces operational suspension. For battery manufacturers, this includes damage from fire, explosion, equipment breakdown, water damage, wind, or other specified perils.

Contingent Business Interruption

This extension covers income loss when disruption occurs at a supplier, customer, or other dependent location. For battery manufacturers, this is crucial given reliance on specialized material suppliers and key customers. Coverage can protect against disruptions at raw material suppliers, contract manufacturers, logistics providers, or major customers whose inability to accept deliveries impacts your production schedule.

Civil Authority Coverage

This provision covers losses when government authorities prohibit access to your facility due to a covered peril affecting nearby properties. This could include evacuation orders, quarantine zones, or access restrictions following incidents near your manufacturing site.

Extended Period of Indemnity

Battery manufacturers often face extended recovery periods beyond physical restoration. This coverage extends the indemnity period to account for the time needed to rebuild customer relationships, ramp production back to pre-loss levels, and regain market position. Extended periods of 180 days or more beyond physical restoration are common for battery manufacturers.

Extra Expense Coverage

This covers extraordinary costs incurred to minimize the interruption period or maintain operations. For battery manufacturers, this might include expedited shipping of replacement equipment from overseas, premium payments for rush delivery of raw materials, costs to rent temporary production equipment, or expenses to temporarily outsource production to contract manufacturers.

Ingress and Egress Coverage

This covers losses when physical access to your facility is prevented by a covered peril, even if your property sustains no direct damage. For battery manufacturers located in industrial parks or areas with limited access routes, this coverage addresses situations where road closures, bridge failures, or nearby incidents prevent employee access or material deliveries.

Calculating Appropriate Coverage Limits

Determining adequate business interruption coverage requires careful analysis of your battery manufacturing operation's financial structure and recovery timeline:

Financial Analysis

Begin with a detailed review of your profit and loss statements, identifying net profit and continuing fixed expenses. For battery manufacturers, fixed costs often represent a substantial portion of total expenses due to facility leases, equipment financing, and retained technical personnel.

Maximum Period of Interruption

Estimate the longest reasonable time required to restore operations following a worst-case scenario. For battery manufacturers, consider equipment lead times, facility reconstruction periods, regulatory approval processes, and production ramp-up time. Many battery manufacturing operations require 12-18 months of coverage or more.

Seasonal Variations

If your production or revenue fluctuates seasonally, ensure your coverage accounts for peak periods. An interruption during high-demand periods results in greater income loss than during slower periods.

Growth Projections

Include anticipated business growth in your coverage calculations. The battery manufacturing industry is experiencing rapid expansion, and your coverage should reflect projected revenue increases rather than only historical performance.

Dependent Property Exposure

Assess your vulnerability to supplier and customer disruptions. Identify critical single-source suppliers, key customers representing significant revenue portions, and essential service providers. This analysis determines appropriate contingent business interruption limits.

The Claims Process for Battery Manufacturers

Immediate Response

When an interruption occurs, immediately notify your insurance broker and carrier. Document the incident thoroughly with photographs, videos, and written descriptions. Secure the facility to prevent additional damage and begin preliminary loss assessment.

Documentation Requirements

Business interruption claims require extensive financial documentation. Gather profit and loss statements, balance sheets, tax returns, production records, sales data, and accounts receivable information. For battery manufacturers, include production logs, quality control records, and inventory documentation showing work-in-process losses.

Loss Calculation

Work with forensic accountants experienced in manufacturing operations to calculate your loss. The calculation compares actual results during the interruption period with projected results had no loss occurred. For battery manufacturers, this analysis must account for production capacity, order backlog, market conditions, and competitive factors.

Mitigation Efforts

Insurance policies require policyholders to take reasonable steps to minimize losses. Document all mitigation efforts, including temporary production arrangements, expedited repairs, and customer communication. These efforts often qualify as extra expenses covered by the policy.

Ongoing Communication

Maintain regular communication with your insurer and claims adjuster. Provide updated financial information, progress reports on restoration efforts, and revised loss projections as circumstances evolve.

Risk Management Strategies to Complement Insurance

While business interruption insurance provides financial protection, proactive risk management reduces the likelihood and severity of interruptions:

Equipment Maintenance Programs

Implement comprehensive preventive maintenance schedules for all critical manufacturing equipment. Regular maintenance reduces breakdown frequency and severity. Maintain relationships with equipment manufacturers and service providers for rapid response when issues arise.

Supply Chain Diversification

Where possible, develop relationships with multiple suppliers for critical raw materials. Maintain strategic inventory of long-lead-time materials. Consider geographic diversification of suppliers to reduce regional risk concentration.

Business Continuity Planning

Develop detailed business continuity plans addressing various disruption scenarios. Identify critical functions, establish recovery time objectives, and document recovery procedures. Conduct regular drills to test plan effectiveness and train personnel.

Fire Prevention and Suppression

Given fire risks in battery manufacturing, invest in robust fire detection and suppression systems. Implement hot work permits, maintain proper material storage, and train employees in fire prevention. Consider specialized suppression systems designed for lithium battery fires.

Cybersecurity Measures

Protect industrial control systems and business networks with comprehensive cybersecurity programs. Implement network segmentation, regular security updates, employee training, and incident response plans. Consider cyber insurance as a complement to business interruption coverage.

Backup Power Systems

Install uninterruptible power supplies and backup generators to maintain critical systems during power outages. Size backup systems to support essential manufacturing processes, not just emergency lighting and safety systems.

Important Policy Considerations

Waiting Periods

Most policies include a waiting period (typically 24-72 hours) before coverage begins. Shorter waiting periods provide broader protection but increase premiums. Consider your ability to absorb short-term interruptions when selecting waiting periods.

Valuation Methods

Policies may use actual loss sustained or agreed value methods. Actual loss sustained bases payments on demonstrated financial impact, while agreed value establishes predetermined payment amounts. For battery manufacturers with complex financial structures, actual loss sustained typically provides more appropriate coverage.

Coinsurance Provisions

Many policies include coinsurance clauses requiring you to maintain coverage equal to a specified percentage of your actual exposure (commonly 80-100%). Underinsurance results in proportional claim payment reductions. Ensure your coverage limits meet coinsurance requirements.

Covered Perils

Review covered perils carefully. All-risk policies provide broader protection than named-peril policies. For battery manufacturers, ensure coverage includes equipment breakdown, which may require a separate endorsement or standalone policy.

Exclusions

Understand policy exclusions, which commonly include wear and tear, intentional acts, war, nuclear hazards, and certain natural disasters. Some exclusions can be addressed through endorsements or separate policies.

Factors Affecting Insurance Costs

Several factors influence business interruption insurance premiums for battery manufacturers:

- Revenue and Profit Levels: Higher revenue and profit margins increase potential losses and premium costs

- Coverage Limits and Periods: Longer indemnity periods and higher limits result in increased premiums

- Waiting Periods: Shorter waiting periods provide broader coverage but cost more

- Facility Characteristics: Building construction, fire protection systems, and location affect risk assessment

- Manufacturing Processes: Processes involving hazardous materials or high fire risk increase premiums

- Risk Management Practices: Strong safety programs, maintenance procedures, and business continuity planning can reduce costs

- Claims History: Previous business interruption claims impact future premium costs

- Geographic Location: Exposure to natural disasters, proximity to emergency services, and local building codes affect pricing

Selecting the Right Coverage for Your Battery Manufacturing Business

Choosing appropriate business interruption insurance requires careful consideration of your specific operational characteristics:

Work with Specialized Brokers

Partner with insurance brokers experienced in manufacturing operations, particularly battery or advanced manufacturing sectors. Specialized brokers understand industry-specific risks and can identify appropriate coverage options.

Conduct Regular Coverage Reviews

Review your coverage annually or when significant operational changes occur. Business expansion, new product lines, facility modifications, or supply chain changes may require coverage adjustments.

Consider Package Policies

Business interruption coverage is often included in commercial property packages or manufacturing-specific policies. Bundled coverage may provide cost efficiencies and simplified administration.

Evaluate Insurer Financial Strength

Select insurers with strong financial ratings (A.M. Best A- or higher) to ensure they can meet substantial claims typical in battery manufacturing interruptions. Review the insurer's experience with complex manufacturing claims and their reputation for prompt, fair claim settlements.

Conclusion: Protecting Your Battery Manufacturing Future

Business interruption insurance is not just a financial safeguard—it's a strategic tool for battery manufacturers navigating an increasingly complex and competitive landscape. As the global transition to renewable energy accelerates, battery manufacturers play a critical role in supporting electric mobility, grid storage, and sustainable technology. Protecting your operational continuity ensures you can meet growing market demands and maintain your competitive position.

The right business interruption insurance provides more than financial compensation. It offers peace of mind, operational resilience, and the ability to quickly recover from unexpected disruptions. By understanding your unique risks, carefully selecting coverage, and implementing robust risk management strategies, you can build a comprehensive protection framework that supports your battery manufacturing business's long-term success.

Remember, in the fast-evolving battery manufacturing industry, your ability to respond quickly and maintain operational continuity can be the difference between market leadership and falling behind. Invest in comprehensive business interruption insurance as a critical component of your strategic risk management approach.

0330 127 2333

0330 127 2333