Battery Manufacturing vs General Manufacturing Insurance: Navigating Unique Risks and Protection Strategies

Published: October 2025

Introduction: The Critical Role of Specialized Insurance in Manufacturing

In the rapidly evolving landscape of manufacturing, understanding the nuanced insurance requirements for different sectors is paramount. While general manufacturing insurance provides a foundational layer of protection, battery manufacturing presents a unique set of risks that demand specialized coverage. This comprehensive guide will explore the critical differences, helping business owners make informed insurance decisions.

Understanding Manufacturing Insurance: The Basics

What is Manufacturing Insurance?

Manufacturing insurance is a comprehensive risk management strategy designed to protect businesses from potential financial losses arising from various operational challenges. These typically include:

- Property damage

- Equipment breakdown

- Business interruption

- Employers' liability

- Product liability

Common Coverage Elements in General Manufacturing

Traditional manufacturing insurance usually encompasses:

- Commercial Property Insurance: Protects physical assets like buildings, machinery, and inventory

- General Liability Insurance: Covers third-party bodily injury and property damage claims

- Product Liability Insurance: Defends against claims arising from product-related injuries or damages

- Business Interruption Insurance: Provides financial support during unexpected operational disruptions

- Employers' Liability Insurance: Protects against employee injury or illness claims

Battery Manufacturing: A Specialized Insurance Landscape

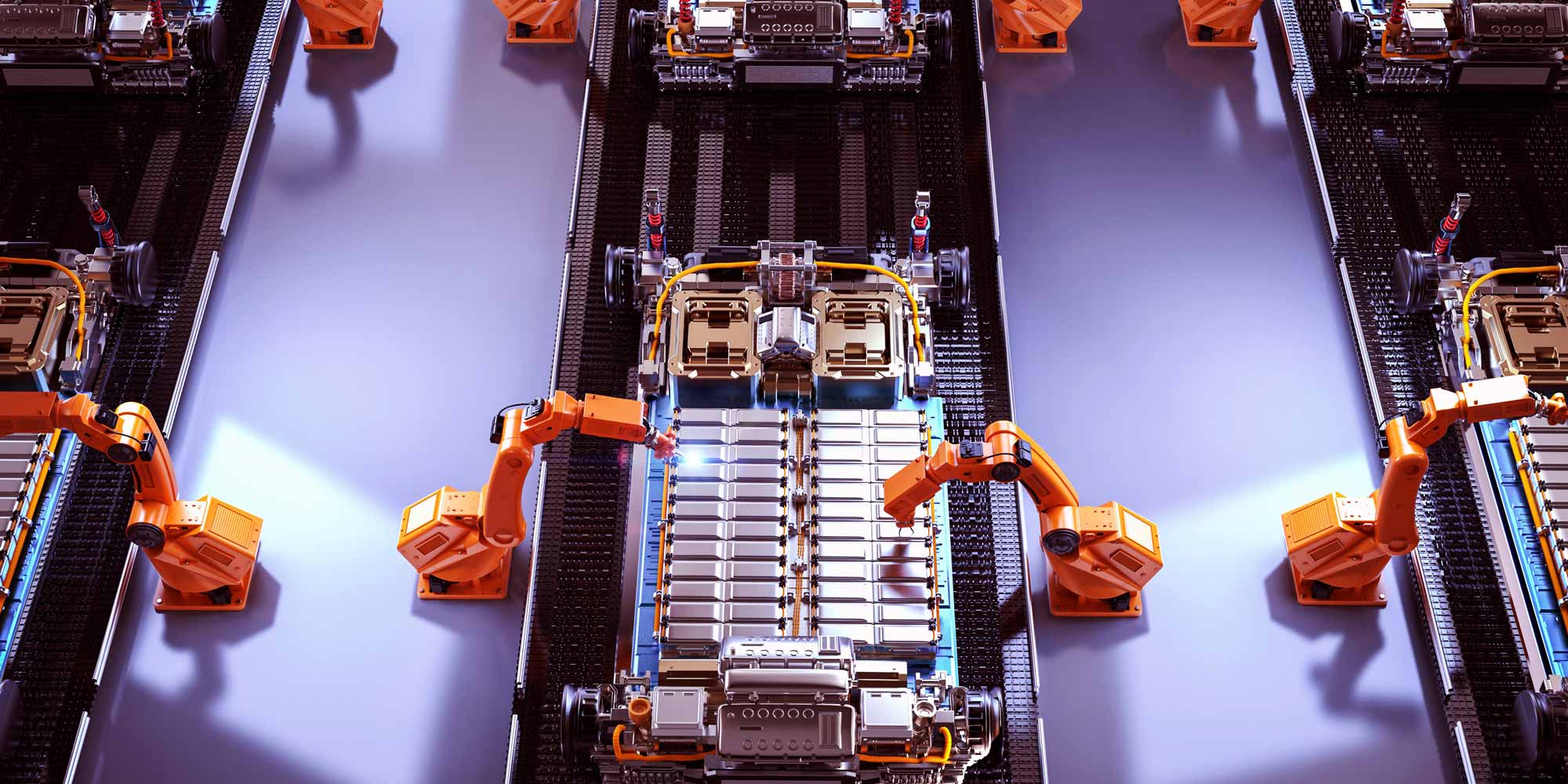

Unique Risks in Battery Production

Battery manufacturing introduces complex risks not typically encountered in general manufacturing:

- Chemical Hazard Risks: Lithium-ion and other battery chemistries involve volatile materials

- Fire and Explosion Potential: Battery production involves high-energy materials with significant thermal runaway risks

- Environmental Contamination: Potential chemical spills and disposal challenges

- Advanced Technology Risks: Cutting-edge manufacturing processes with higher technological complexity

Specialized Insurance Requirements for Battery Manufacturers

Beyond standard manufacturing coverage, battery manufacturers should consider:

- Environmental Liability Insurance: Comprehensive protection against chemical spills and contamination

- Product Recall Insurance: Critical for addressing potential battery defects or safety issues

- Cyber Insurance: Protecting advanced manufacturing technologies and intellectual property

- Extended Product Liability: Covering potential long-term performance and safety issues

- Research and Development Insurance: Protecting investments in innovative battery technologies

Comparative Risk Analysis: Battery vs General Manufacturing

| Risk Category | General Manufacturing | Battery Manufacturing |

|---|---|---|

| Fire Risk | Standard industrial risks | Extremely high due to chemical volatility |

| Environmental Impact | Moderate | High (chemical disposal, potential contamination) |

| Technology Complexity | Standard manufacturing processes | High-tech, rapidly evolving |

| Product Liability Exposure | Standard consumer product risks | Extensive (safety, performance, long-term reliability) |

Cost Considerations: Insurance Premiums and Risk Management

Battery manufacturers can expect higher insurance premiums due to:

- Increased risk profile

- Higher potential for significant claims

- Complex technological landscape

- Evolving regulatory environment

Risk Mitigation Strategies

To manage insurance costs and risks, battery manufacturers should:

- Implement rigorous safety protocols

- Invest in advanced risk management technologies

- Maintain comprehensive documentation

- Regularly update safety training programs

- Work closely with specialized insurance providers

Emerging Trends: The Future of Manufacturing Insurance

The manufacturing insurance landscape is rapidly evolving, with particular emphasis on:

- AI-driven risk assessment

- Real-time monitoring technologies

- Customized, data-driven insurance products

- Increased focus on sustainability and environmental protection

Conclusion: Tailored Protection for Complex Manufacturing Environments

While general manufacturing insurance provides essential protection, battery manufacturers require a more nuanced, specialized approach. By understanding the unique risks and investing in comprehensive, targeted insurance coverage, businesses can safeguard their operations, employees, and future innovations.

0330 127 2333

0330 127 2333