Battery Manufacturing Insurance Tax Relief & Incentives: Protecting Your Green Energy Investment

A Comprehensive Guide for UK Battery Manufacturers Navigating Financial Strategies and Risk Management

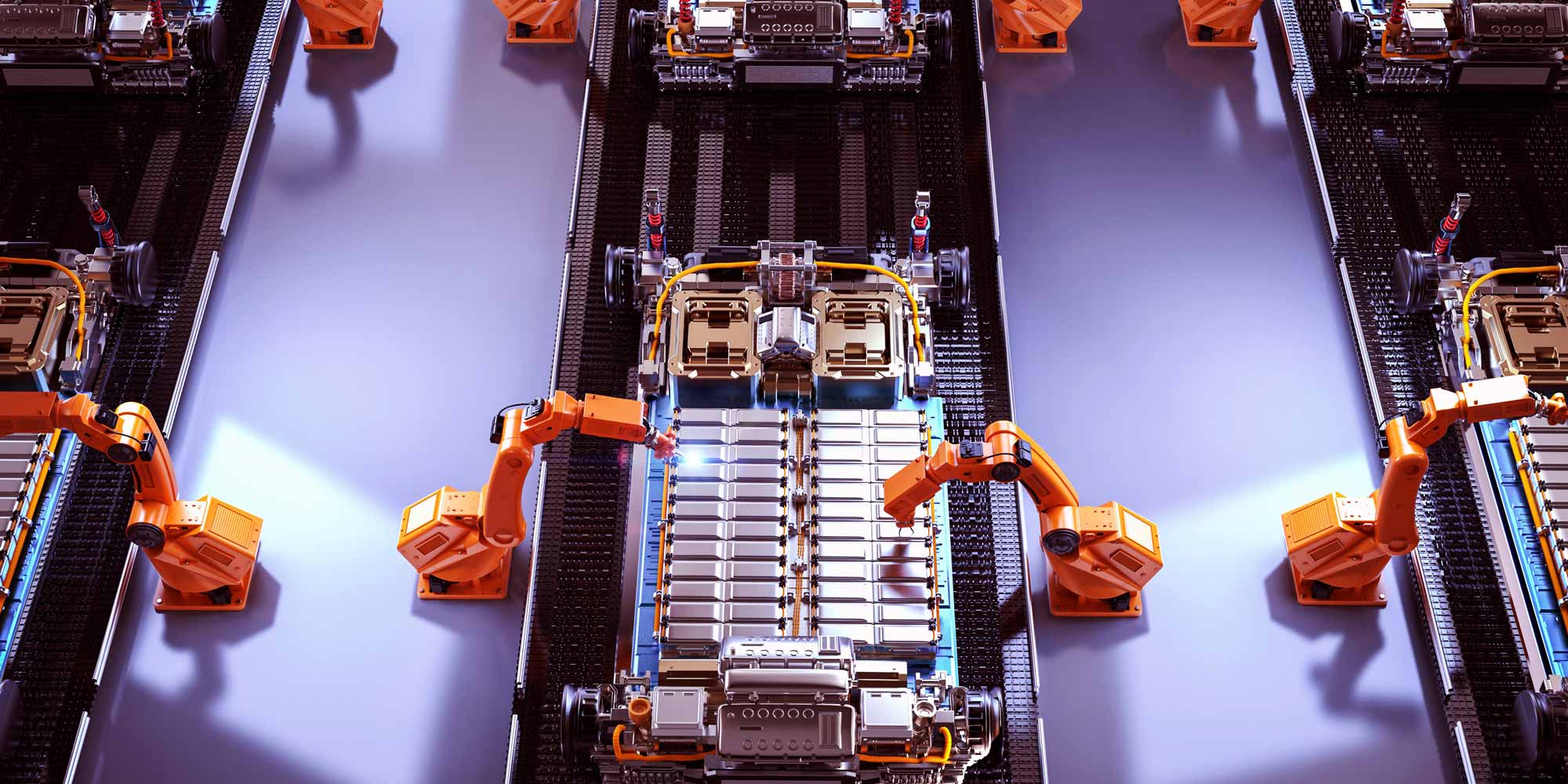

Introduction: The Evolving Landscape of Battery Manufacturing

The battery manufacturing sector is experiencing unprecedented growth, driven by the global transition to green energy and electric vehicle technologies. As this industry expands, understanding the complex landscape of tax relief, incentives, and comprehensive insurance coverage becomes crucial for businesses seeking sustainable growth and risk mitigation.

Understanding Tax Relief in Battery Manufacturing

Research and Development (R&D) Tax Credits

Battery manufacturers investing in innovative technologies can benefit significantly from R&D tax credits. The UK government offers substantial tax relief for companies developing advanced battery technologies, including:

- Enhanced deduction of up to 130% on qualifying R&D expenditures

- Cash credits for loss-making companies

- Eligible expenses include prototype development, material testing, and process optimization

Capital Allowances for Green Technology

Investments in green manufacturing equipment can unlock significant tax advantages:

- 100% first-year allowance for qualifying green technology investments

- Enhanced capital allowances for energy-efficient manufacturing equipment

- Potential tax deductions for renewable energy infrastructure

Comprehensive Insurance Strategies for Battery Manufacturers

Specialized Commercial Combined Insurance

Battery manufacturing presents unique risks requiring tailored insurance solutions:

- Property insurance covering specialized manufacturing equipment

- Business interruption protection for complex production processes

- Material damage coverage for high-value battery components

Product Liability and Professional Indemnity

Critical coverage areas for battery manufacturers include:

- Protection against potential manufacturing defects

- Coverage for performance guarantees and technical specifications

- Legal defense costs in case of product-related incidents

Cyber Insurance for High-Tech Manufacturing

Advanced battery manufacturing relies heavily on digital technologies, necessitating robust cyber protection:

- Coverage for intellectual property theft

- Protection against industrial espionage

- Business interruption coverage for digital system failures

Government Incentives for Battery Manufacturing

Green Investment Schemes

The UK government has introduced several incentive programs to support battery manufacturing:

- Automotive Transformation Fund

- Grants for sustainable manufacturing technologies

- Low-carbon innovation support programs

Regional Development Grants

Additional funding opportunities exist for manufacturers in specific regions:

- Targeted support for manufacturing in economically challenged areas

- Job creation incentives

- Infrastructure development grants

Comprehensive Risk Management Strategies

Environmental and Safety Compliance

Battery manufacturers must navigate complex regulatory landscapes:

- Adherence to UK and EU environmental regulations

- Workplace safety standards for chemical and electrical risks

- Waste management and recycling compliance

Supply Chain Risk Mitigation

Strategic approaches to managing supply chain vulnerabilities:

- Diversification of raw material suppliers

- Inventory insurance for critical components

- Business continuity planning

Strategic Financial Planning for Battery Manufacturers

Tax Efficiency Strategies

Maximizing financial performance through strategic tax planning:

- Timing of capital investments

- Leveraging research and development credits

- Structuring investments to optimize tax benefits

Insurance Cost Optimization

Approaches to managing insurance expenses while maintaining comprehensive coverage:

- Regular risk assessments

- Implementing robust safety protocols

- Bundling insurance products for cost efficiency

Conclusion: Navigating a Complex Landscape

Battery manufacturing represents a dynamic and promising sector with significant opportunities for growth. By understanding and strategically leveraging tax relief, government incentives, and comprehensive insurance solutions, manufacturers can build resilient, innovative, and financially optimized businesses.

Frequently Asked Questions

Q: How often should battery manufacturers review their insurance coverage?

A: Annually, or whenever significant technological or operational changes occur.

Q: Are R&D tax credits applicable to battery recycling technologies?

A: Yes, innovations in battery recycling and circular economy technologies often qualify for R&D tax credits.

Q: What are the key considerations for cyber insurance in battery manufacturing?

A: Focus on protecting intellectual property, manufacturing process data, and ensuring business continuity in case of digital disruptions.

0330 127 2333

0330 127 2333