Battery Manufacturing Insurance: Navigating Coverage for Franchise and Independent Businesses

Introduction: The Critical Role of Insurance in Battery Manufacturing

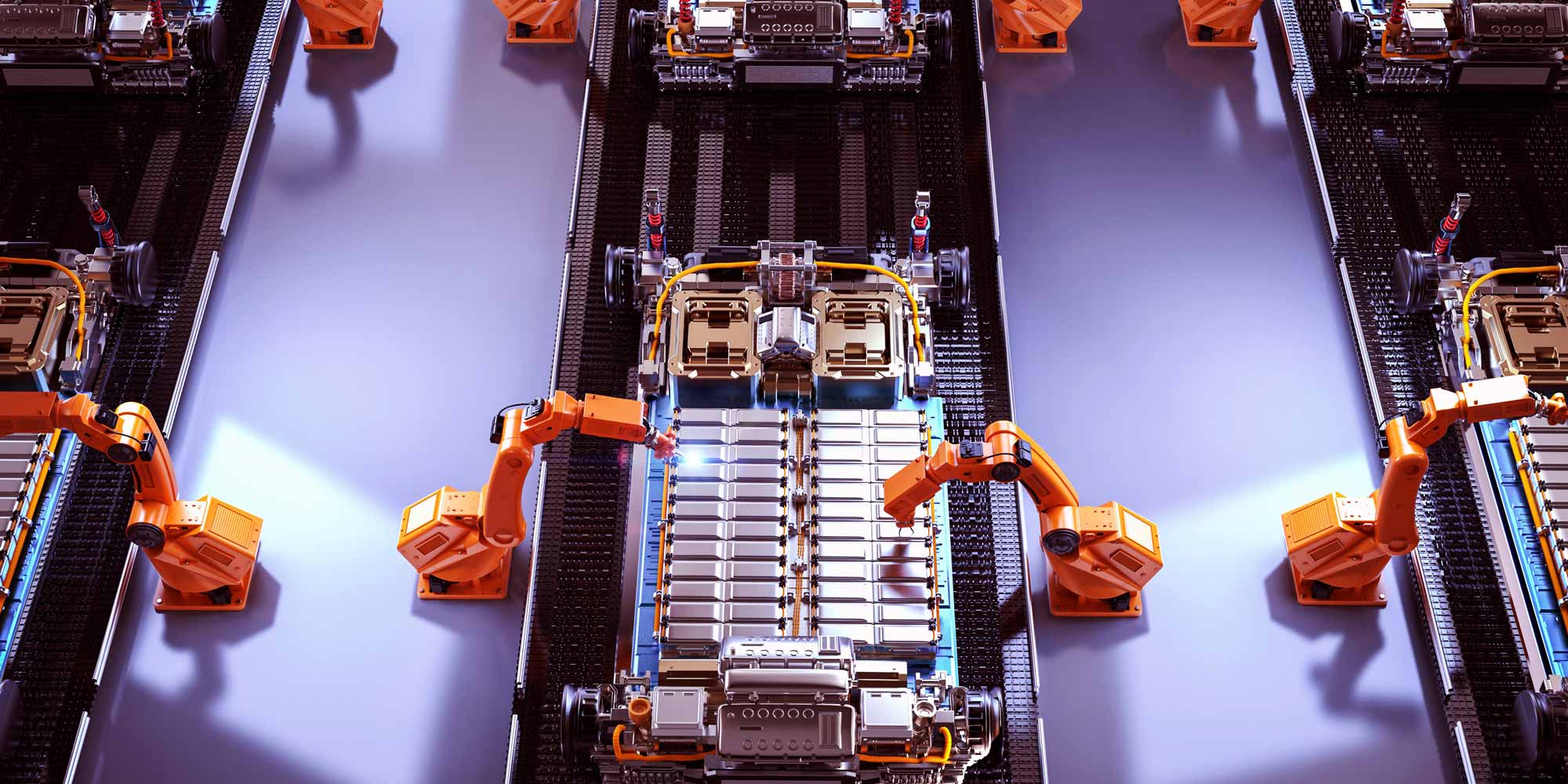

The battery manufacturing landscape is rapidly evolving, driven by technological advancements, increasing demand for electric vehicles, renewable energy storage, and consumer electronics. As this sector grows, so do the complex risks facing both franchise and independent battery manufacturers. This comprehensive guide explores the unique insurance challenges, coverage requirements, and strategic considerations for protecting your battery manufacturing business.

Battery Manufacturing: An Industry in Transformation

Market Dynamics

- Global battery market projected to reach $360 billion by 2030

- Electric vehicle battery segment experiencing exponential growth

- Increasing demand from renewable energy, consumer electronics, and industrial applications

Key Manufacturing Segments

- Lithium-ion battery production

- Lead-acid battery manufacturing

- Emerging technologies: Solid-state, sodium-ion, and alternative chemistries

Franchise vs Independent: Structural Differences and Insurance Implications

Franchise Battery Manufacturers

Franchise battery manufacturers operate under a larger brand's established framework, benefiting from:

- Standardized manufacturing processes

- Centralized quality control

- Established supply chain networks

- Brand recognition and market credibility

Independent Battery Manufacturers

Independent manufacturers offer unique advantages but face distinct challenges:

- Greater flexibility in innovation

- Customized production capabilities

- More agile decision-making processes

- Higher risk exposure due to limited resources

Common Risks in Battery Manufacturing

Product Liability Risks

- Battery performance and safety failures

- Potential fire or thermal runaway incidents

- Chemical contamination or manufacturing defects

- Environmental damage from battery materials

Operational Risks

- Equipment breakdown

- Supply chain disruptions

- Intellectual property challenges

- Cybersecurity threats

Essential Insurance Coverage for Battery Manufacturers

Franchise Manufacturer Insurance Considerations

- Comprehensive General Liability: Broader coverage through franchisor's master policy

- Product Liability Insurance: Often centrally managed with higher coverage limits

- Intellectual Property Protection: Enhanced through franchisor's legal support

- Business Interruption Coverage: More robust due to centralized risk management

Independent Manufacturer Insurance Requirements

- Customized Product Liability: Tailored to specific manufacturing processes

- Professional Indemnity Insurance: Protection against design and manufacturing errors

- Cyber Insurance: Critical for protecting proprietary manufacturing technologies

- Environmental Liability Coverage: Protection against potential chemical or waste-related incidents

Risk Mitigation Strategies

For Franchise Manufacturers

- Strict adherence to franchisor's quality control standards

- Regular training and certification programs

- Comprehensive documentation of manufacturing processes

- Proactive maintenance of manufacturing equipment

For Independent Manufacturers

- Invest in rigorous testing and quality assurance

- Develop comprehensive standard operating procedures

- Maintain detailed records of manufacturing processes

- Implement advanced cybersecurity measures

Insurance Cost Factors

Insurance premiums for battery manufacturers are influenced by multiple factors:

- Manufacturing volume

- Battery chemistry and technology

- Historical claim records

- Risk management practices

- Geographic location and regulatory environment

Potential Cost Savings Strategies

- Implement robust safety protocols

- Regular equipment maintenance

- Comprehensive staff training programs

- Advanced risk management systems

Regulatory Compliance and Insurance

Battery manufacturers must navigate complex regulatory landscapes:

- Environmental Protection Agency (EPA) regulations

- Occupational Safety and Health Administration (OSHA) guidelines

- International transportation and shipping regulations

- Emerging sustainability and recycling standards

Future of Battery Manufacturing Insurance

Emerging trends shaping insurance in battery manufacturing:

- Integration of AI and machine learning in risk assessment

- Increased focus on sustainable and circular economy practices

- More granular, technology-specific insurance products

- Enhanced cybersecurity and intellectual property protection

Conclusion: Protecting Your Battery Manufacturing Future

Whether you're a franchise or independent battery manufacturer, comprehensive insurance is not just a regulatory requirement—it's a strategic asset. By understanding your unique risks, implementing robust risk management practices, and securing tailored insurance coverage, you can protect your business, drive innovation, and contribute to the growing battery technology ecosystem.

Frequently Asked Questions

Q1: How different are insurance requirements for franchise and independent battery manufacturers?

While core insurance needs are similar, franchise manufacturers often benefit from centralized, broader coverage, whereas independent manufacturers require more customized, flexible insurance solutions.

Q2: What is the most critical insurance for battery manufacturers?

Product liability insurance is crucial, protecting against potential failures, safety incidents, and financial losses from manufacturing defects.

Q3: How can battery manufacturers reduce insurance premiums?

Implement rigorous safety protocols, maintain detailed documentation, invest in staff training, and demonstrate proactive risk management practices.

0330 127 2333

0330 127 2333