Battery Manufacturing Insurance: Comprehensive Cost Factors and Risk Management Guide

Introduction: The Critical Role of Insurance in Battery Manufacturing

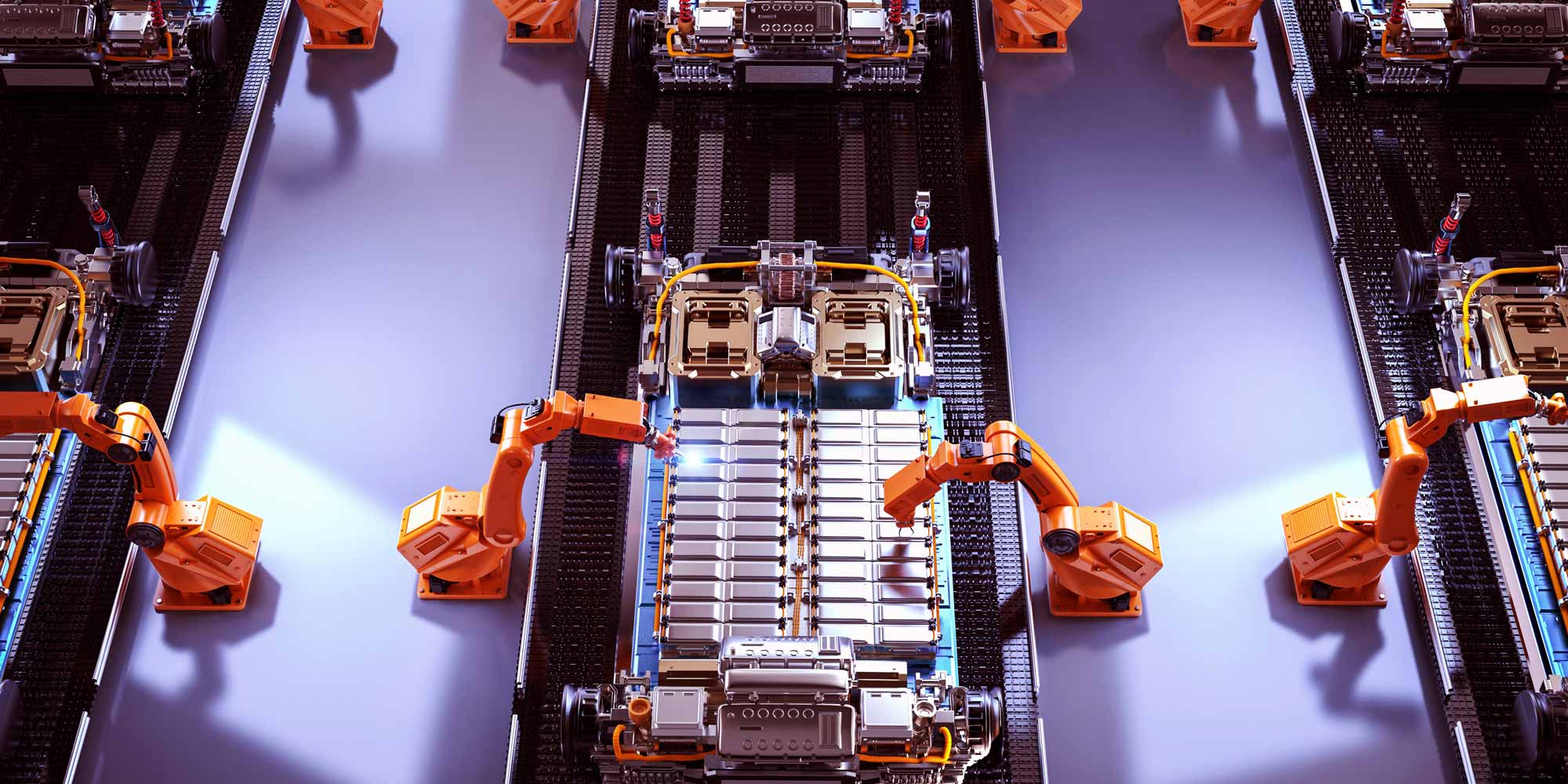

The battery manufacturing industry stands at the forefront of technological innovation, driving the transition to sustainable energy and powering everything from electric vehicles to renewable energy storage systems. However, this cutting-edge sector comes with complex and significant risks that demand sophisticated insurance solutions.

This comprehensive guide explores the intricate landscape of insurance cost factors for battery manufacturers, providing insights into risk assessment, coverage types, and strategic approaches to protecting your business's financial stability.

Understanding Unique Risks in Battery Manufacturing

Technological and Production Risks

- Chemical Hazard Exposure

- Fire and Explosion Risks

- Environmental Contamination Potential

- Product Liability from Manufacturing Defects

- Intellectual Property and Technology Risks

Chemical and Material Risks

Battery manufacturing involves handling volatile and potentially dangerous materials such as lithium, cobalt, nickel, and various electrolytes. These materials present significant risks:

- Potential for spontaneous chemical reactions

- High-temperature processing environments

- Risk of toxic chemical spills

- Complex supply chain vulnerabilities

Essential Insurance Coverage Types for Battery Manufacturers

1. Property Insurance

Protects physical assets against damage from fires, explosions, natural disasters, and equipment breakdown. Key considerations include:

- Replacement cost of specialized manufacturing equipment

- Coverage for chemical storage facilities

- Business interruption protection

2. Product Liability Insurance

Critical for addressing potential claims arising from battery defects, including:

- Manufacturing errors leading to product failures

- Performance inconsistencies

- Safety incidents in end-user applications

- Potential recall expenses

3. Environmental Liability Insurance

Addresses risks associated with chemical handling and potential environmental contamination:

- Cleanup costs for chemical spills

- Legal expenses from environmental damage claims

- Regulatory compliance protection

4. Cyber Insurance

Protects against technological and digital risks specific to advanced manufacturing:

- Intellectual property theft

- Manufacturing system disruptions

- Data breach protection

- Ransomware and technological attack coverage

Primary Cost Factors in Battery Manufacturing Insurance

1. Risk Profile Assessment

Insurers evaluate multiple dimensions of your manufacturing operation:

- Manufacturing technology sophistication

- Historical safety record

- Quality control processes

- Research and development investment

- Supply chain resilience

2. Manufacturing Scale and Complexity

Insurance premiums directly correlate with:

- Annual production volume

- Number of manufacturing facilities

- Geographical distribution of operations

- Technological complexity of battery types produced

3. Material and Chemical Handling Protocols

Comprehensive risk mitigation strategies can significantly reduce insurance costs:

- Advanced chemical storage systems

- Rigorous safety training programs

- Real-time monitoring technologies

- Documented emergency response procedures

Strategic Risk Management for Cost Optimization

1. Proactive Safety Investments

Implementing advanced safety technologies and protocols can lead to:

- Reduced insurance premiums

- Lower potential liability exposure

- Enhanced operational efficiency

2. Comprehensive Documentation

Maintain meticulous records of:

- Quality control processes

- Safety incident responses

- Employee training programs

- Technological upgrades and improvements

3. Regular Risk Assessments

Conduct periodic comprehensive risk evaluations to:

- Identify emerging technological risks

- Update insurance coverage

- Demonstrate commitment to risk management

Conclusion: Insurance as a Strategic Business Asset

Battery manufacturing insurance is not merely a compliance requirement but a strategic tool for business resilience. By understanding cost factors, investing in risk management, and selecting comprehensive coverage, manufacturers can protect their innovative ventures and maintain financial stability.

As the battery technology landscape continues to evolve rapidly, staying ahead of potential risks through intelligent insurance strategies is crucial for sustainable growth and success.

Frequently Asked Questions

Q1: How often should battery manufacturers review their insurance coverage?

Annually, or whenever significant technological or operational changes occur.

Q2: Can small battery manufacturers afford comprehensive insurance?

Many insurers offer scalable solutions tailored to different business sizes and risk profiles.

Q3: What's the most critical insurance type for battery manufacturers?

Product liability and property insurance are typically the most crucial coverage types.

0330 127 2333

0330 127 2333