Battery Manufacturing Insurance Claims Process: Navigating Risks and Protecting Your Business

Introduction: The Critical Role of Insurance in Battery Manufacturing

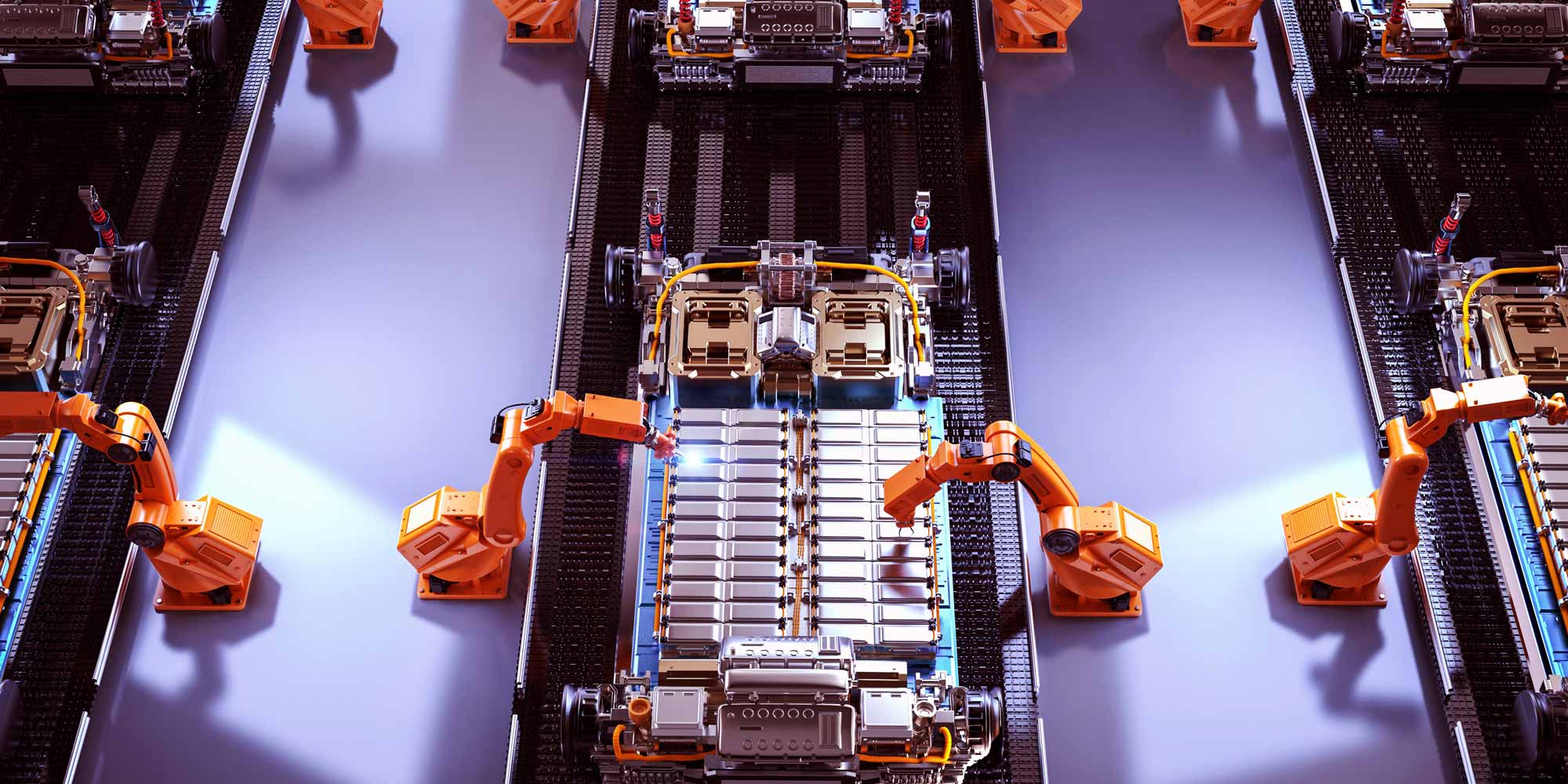

Battery manufacturing is a complex, high-stakes industry where technological innovation meets significant operational risks. From lithium-ion production to cutting-edge electric vehicle battery systems, manufacturers face unique challenges that demand comprehensive insurance protection. This guide explores the intricate insurance claims process, helping battery manufacturers understand, prepare for, and effectively navigate potential risks.

Understanding Unique Risks in Battery Manufacturing

Technological and Operational Hazards

- Chemical Exposure and Contamination Risks

- High-Temperature Manufacturing Processes

- Potential for Electrical and Fire Hazards

- Complex Supply Chain Vulnerabilities

- Environmental Compliance Challenges

Financial and Operational Impact of Unmitigated Risks

Unaddressed risks can result in:

- Substantial Production Interruptions

- Significant Equipment Replacement Costs

- Potential Environmental Remediation Expenses

- Legal Liabilities and Regulatory Penalties

- Reputational Damage

Essential Insurance Coverage for Battery Manufacturers

Comprehensive Insurance Portfolio

- Commercial Combined Insurance

- Property Damage Protection

- Business Interruption Coverage

- Equipment Breakdown Insurance

- Product Liability Insurance

- Protection Against Manufacturing Defects

- Coverage for Potential Battery Performance Issues

- Legal Defense Costs

- Professional Indemnity Insurance

- Protection for Design and Engineering Consultations

- Coverage for Technological Advice

- Safeguard Against Intellectual Property Disputes

- Cyber Insurance

- Data Breach Protection

- Technological System Failure Coverage

- Intellectual Property Theft Defense

- Environmental Liability Insurance

- Chemical Spill and Contamination Coverage

- Remediation Expense Protection

- Regulatory Compliance Support

Detailed Insurance Claims Process for Battery Manufacturers

Pre-Claim Preparation

- Documentation Management

Maintain meticulous records of:

- Manufacturing Processes

- Quality Control Protocols

- Equipment Maintenance Logs

- Safety Inspection Reports

- Technological Specifications

- Risk Assessment and Mitigation

Implement proactive risk management strategies:

- Regular Safety Audits

- Continuous Staff Training

- Advanced Monitoring Systems

- Comprehensive Standard Operating Procedures

Claim Initiation Steps

- Immediate Incident Reporting

Critical actions when an incident occurs:

- Contact Insurance Provider Immediately

- Preserve Incident Scene Evidence

- Complete Preliminary Incident Report

- Notify Relevant Regulatory Bodies

- Comprehensive Documentation

Gather essential claim documentation:

- Detailed Incident Description

- Photographic and Video Evidence

- Equipment Damage Assessment

- Financial Impact Statements

- Witness Statements

Claims Investigation and Processing

- Insurance Provider Assessment

Typical investigation stages:

- Initial Claim Review

- On-Site Inspection

- Expert Technical Evaluation

- Financial Impact Analysis

- Collaborative Resolution

Work closely with insurance adjusters by:

- Providing Transparent Information

- Responding Promptly to Queries

- Facilitating Expert Assessments

- Demonstrating Proactive Risk Management

Potential Challenges in Battery Manufacturing Insurance Claims

Common Claim Complexities

- Technological Complexity of Battery Systems

- Evolving Regulatory Landscape

- Rapid Technological Advancements

- Global Supply Chain Interdependencies

- Environmental and Safety Regulations

Strategies for Successful Claims Management

- Maintain Comprehensive Documentation

- Invest in Continuous Staff Training

- Implement Advanced Monitoring Technologies

- Foster Transparent Communication with Insurers

- Stay Updated on Industry Regulations

Conclusion: Proactive Protection in Battery Manufacturing

Navigating insurance claims in battery manufacturing requires a strategic, comprehensive approach. By understanding potential risks, maintaining rigorous documentation, and working collaboratively with insurance providers, manufacturers can protect their operations, financial stability, and reputation.

Remember: Effective insurance is not just about claims processing—it's about creating a robust risk management ecosystem that supports innovation, safety, and sustainable growth.

0330 127 2333

0330 127 2333