Battery Manufacturing Insurance: Protecting Your Startup's Future in the Green Energy Revolution

A Comprehensive Guide to Navigating Insurance Risks in the Emerging Battery Technology Sector

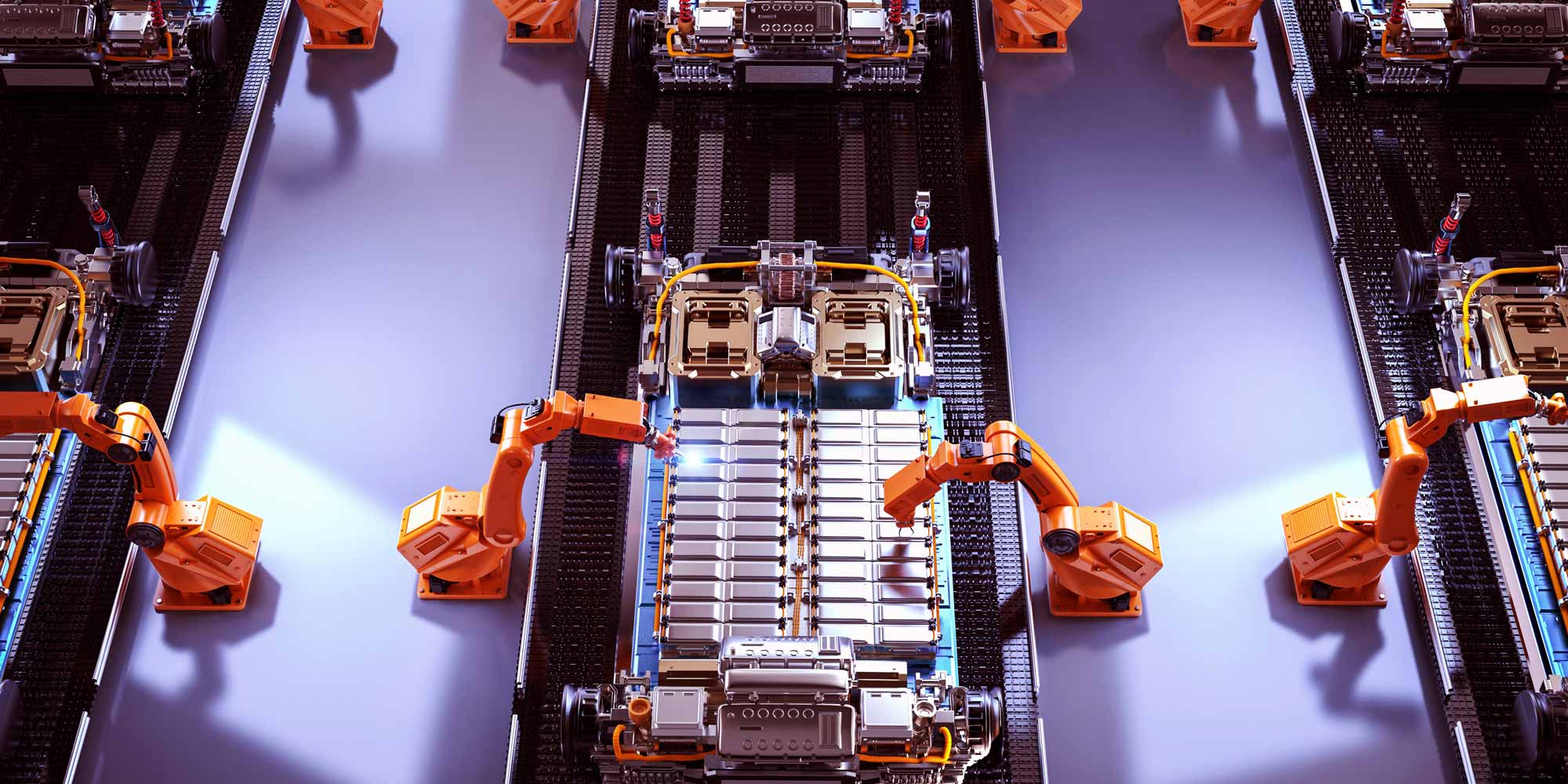

Introduction: The Battery Manufacturing Landscape in 2025

The battery manufacturing sector has emerged as a critical cornerstone of the green energy transition, with startups playing a pivotal role in driving technological innovation. As the demand for advanced energy storage solutions continues to surge, battery manufacturing startups face a complex landscape of technological, operational, and financial risks that demand comprehensive insurance protection.

This guide will walk you through the essential insurance considerations, helping you safeguard your startup's assets, intellectual property, and future potential.

Understanding the Unique Risks in Battery Manufacturing

Technological Risks

- Potential for manufacturing defects leading to battery failure

- Intellectual property disputes and patent infringement challenges

- Rapid technological obsolescence

- Research and development investment protection

Operational Risks

- Chemical and material handling hazards

- Fire and explosion risks associated with lithium-ion production

- Environmental contamination potential

- Supply chain disruption vulnerabilities

Financial Risks

- High initial capital investment requirements

- Product liability exposure

- Potential recall scenarios

- Market volatility in the green energy sector

Essential Insurance Coverage for Battery Manufacturing Startups

1. Product Liability Insurance

Critical for protecting against claims arising from battery malfunctions, potential safety incidents, or performance failures. This insurance covers legal expenses, compensation claims, and potential product recall costs.

2. Professional Indemnity Insurance

Protects against claims of professional negligence, design errors, or technical consultancy mistakes. Particularly crucial for startups developing cutting-edge battery technologies.

3. Commercial Combined Insurance

A comprehensive package that typically includes:

- Property damage protection

- Business interruption coverage

- Equipment breakdown insurance

- Stock and inventory protection

4. Cyber Insurance

Essential for protecting intellectual property, research data, and operational technologies from digital threats. Covers potential data breaches, ransomware attacks, and technological system failures.

5. Environmental Liability Insurance

Crucial for battery manufacturers dealing with potentially hazardous chemical processes. Covers environmental cleanup costs, pollution-related damages, and regulatory compliance challenges.

Risk Mitigation Strategies for Battery Manufacturing Startups

Technological Safeguards

- Implement rigorous quality control processes

- Maintain comprehensive documentation of manufacturing procedures

- Invest in continuous staff training

- Develop robust testing and validation protocols

Operational Best Practices

- Maintain strict chemical handling and storage protocols

- Implement advanced fire suppression systems

- Develop comprehensive emergency response plans

- Regular equipment maintenance and calibration

Understanding Insurance Costs and Factors

Insurance premiums for battery manufacturing startups are influenced by multiple factors:

- Company size and annual revenue

- Specific battery technology being developed

- Manufacturing processes and safety records

- Research and development investment

- Geographic location and operational environment

Typical annual insurance costs can range from £50,000 to £250,000, depending on the complexity and scale of operations.

Regulatory Compliance and Insurance

Battery manufacturing startups must navigate a complex regulatory landscape, including:

- UK Health and Safety regulations

- Environmental Protection Act requirements

- REACH (Registration, Evaluation, Authorization, and Restriction of Chemicals) compliance

- Battery waste and recycling regulations

Comprehensive insurance coverage helps ensure ongoing regulatory compliance and provides financial protection against potential legal challenges.

The Future of Battery Manufacturing: Emerging Trends and Insurance Implications

As the battery manufacturing sector continues to evolve, startups can expect:

- Increased focus on sustainable and recyclable battery technologies

- Growing demand for solid-state and alternative battery chemistries

- More sophisticated risk assessment models

- Potential for specialized, technology-specific insurance products

Conclusion: Insurance as a Strategic Asset

For battery manufacturing startups, comprehensive insurance is more than a regulatory requirement—it's a strategic asset that provides financial security, operational confidence, and a foundation for sustainable growth.

By understanding and proactively managing risks through tailored insurance solutions, startups can focus on what they do best: driving innovation in the green energy revolution.

0330 127 2333

0330 127 2333