The automotive components manufacturing industry forms the backbone of the global automotive sector, producing everything from engine parts and transmission systems to electronic components and safety equipment. With the industry's complex supply chains, stringent quality requirements, and evolving technology landscape, manufacturers face unique risks that require specialized insurance protection.

This comprehensive guide explores the essential insurance coverages for automotive components manufacturers, helping you understand the risks, protect your business, and maintain operational continuity in an increasingly competitive market.

Understanding the Automotive Components Manufacturing Landscape

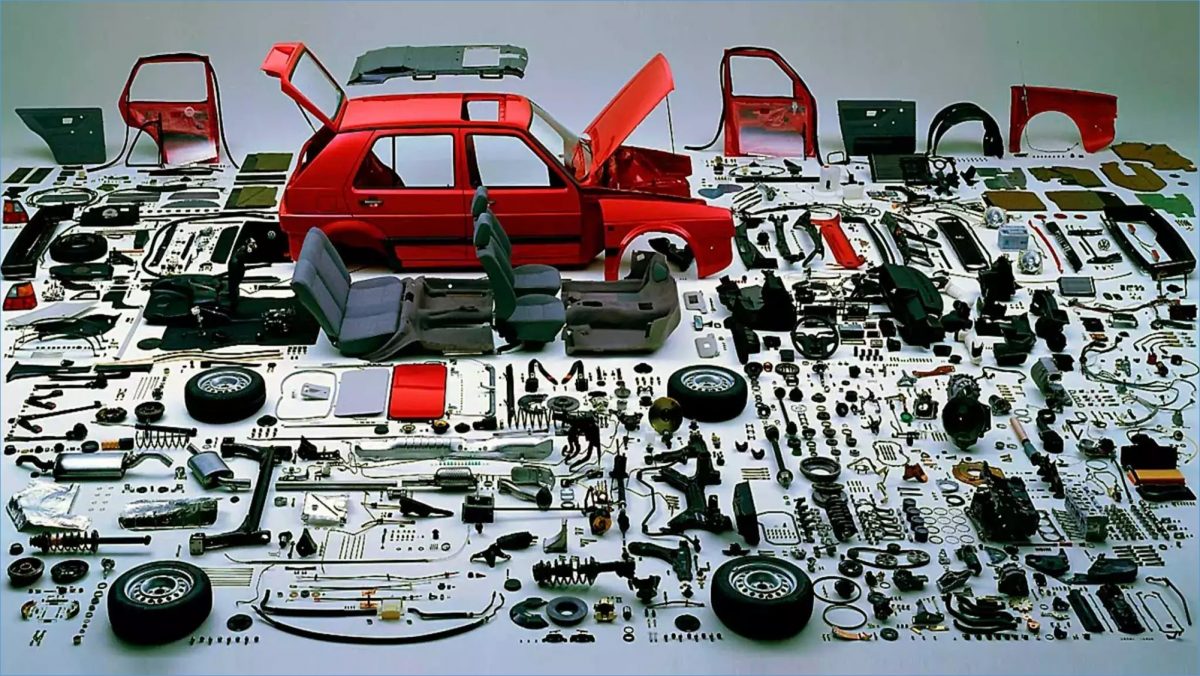

The automotive components manufacturing sector encompasses a vast range of businesses, from small specialized suppliers producing niche parts to large multinational corporations manufacturing critical systems. The industry includes:

- Engine and Powertrain Components: Pistons, crankshafts, camshafts, transmission parts

- Electrical and Electronic Systems: ECUs, sensors, wiring harnesses, infotainment systems

- Safety and Security Components: Airbags, ABS systems, seat belts, anti-theft devices

- Body and Chassis Parts: Panels, frames, suspension components, steering systems

- Interior and Comfort Features: Seats, dashboard components, climate control systems

- Aftermarket Components: Replacement parts, performance upgrades, accessories

Each category presents distinct manufacturing challenges and risk profiles, requiring tailored insurance solutions to address specific operational hazards and liability exposures.

Major Risks Facing Automotive Components Manufacturers

Product Liability and Recall Risks

Automotive components must meet stringent safety and performance standards. A defective part can lead to vehicle accidents, injuries, or fatalities, resulting in significant liability claims. Product recalls can cost millions and damage brand reputation permanently.

Supply Chain Disruptions

Modern automotive manufacturing relies on just-in-time delivery systems. Disruptions from natural disasters, political instability, or supplier failures can halt production lines and breach delivery contracts with OEMs.

Equipment and Machinery Breakdown

Sophisticated manufacturing equipment, including CNC machines, robotic assembly lines, and testing apparatus, represents significant capital investment. Equipment failures can cause production delays and costly repairs.

Quality Control Failures

Inadequate quality control can result in defective products reaching the market, leading to warranty claims, recalls, and damage to customer relationships with major automotive manufacturers.

Cyber Security Threats

Increasing digitalization and Industry 4.0 technologies expose manufacturers to cyber attacks that can disrupt operations, steal intellectual property, or compromise customer data.

Environmental and Regulatory Compliance

Manufacturing processes often involve hazardous materials and generate waste. Environmental incidents or regulatory violations can result in fines, cleanup costs, and business interruption.

Essential Insurance Coverages for Automotive Components Manufacturers

Product Liability Insurance

This is arguably the most critical coverage for automotive components manufacturers. Product liability insurance protects against claims arising from defective products that cause injury, death, or property damage. Coverage should include:

- Bodily injury and property damage claims

- Legal defense costs and settlements

- Product recall expenses

- Regulatory defense costs

- Crisis management and public relations support

Given the potential for catastrophic losses in automotive applications, manufacturers should consider high policy limits and worldwide coverage.

Commercial Property Insurance

Protects manufacturing facilities, equipment, inventory, and other physical assets against perils such as fire, explosion, theft, and natural disasters. Key considerations include:

- Replacement cost coverage for buildings and equipment

- Coverage for raw materials and finished goods

- Protection for specialized tooling and dies

- Coverage for equipment breakdown and mechanical failure

- Ordinance and law coverage for building code upgrades

Business Interruption Insurance

Manufacturing operations depend on continuous production to meet delivery schedules. Business interruption insurance covers lost income and ongoing expenses when operations are suspended due to covered perils:

- Lost profits during shutdown periods

- Continuing expenses like payroll and loan payments

- Extra expenses to minimize business interruption

- Contingent business interruption from supplier failures

- Extended period of indemnity for complex recovery

General Liability Insurance

Provides broad protection against third-party claims for bodily injury and property damage occurring on your premises or arising from your operations:

- Premises liability for visitor injuries

- Operations liability during manufacturing activities

- Completed operations coverage

- Personal and advertising injury protection

- Medical payments coverage

Workers' Compensation Insurance

Manufacturing environments present various workplace hazards. Workers' compensation provides mandatory coverage for employee injuries and illnesses:

- Medical expenses for work-related injuries

- Lost wage benefits for injured employees

- Disability benefits for permanent impairments

- Return-to-work programs and rehabilitation

- Employer liability protection

Cyber Liability Insurance

As manufacturing becomes increasingly connected, cyber insurance becomes essential:

- Data breach response and notification costs

- Business interruption from cyber attacks

- Cyber extortion and ransomware protection

- Third-party liability for data breaches

- System restoration and forensic investigation costs

Professional Indemnity Insurance

For manufacturers providing design, engineering, or consulting services alongside component production:

- Errors and omissions in design or specifications

- Failure to meet performance standards

- Intellectual property infringement claims

- Breach of contract allegations

- Legal defense and settlement costs

Environmental Liability Insurance

Manufacturing processes often involve chemicals, metals, and other potentially hazardous materials:

- Pollution cleanup and remediation costs

- Third-party environmental damage claims

- Regulatory fines and penalties

- Business interruption from environmental incidents

- Transportation pollution coverage

Specialized Insurance Considerations

International Operations Coverage

Many automotive components manufacturers operate globally or export products worldwide. Insurance programs must provide adequate coverage across all jurisdictions, considering varying legal systems, regulatory requirements, and liability exposures.

Supply Chain Insurance

Given the interconnected nature of automotive supply chains, manufacturers should consider coverage for supply chain disruptions, including contingent business interruption and supplier default insurance.

Transit and Cargo Insurance

Components often travel long distances between manufacturing facilities and assembly plants. Marine cargo insurance protects against loss or damage during transit, while logistics liability coverage addresses transportation-related exposures.

Key Person Insurance

Manufacturing operations often depend on key personnel with specialized knowledge or customer relationships. Key person insurance provides financial protection if critical employees become unavailable.

Risk Management Best Practices

Effective risk management goes beyond insurance coverage. Automotive components manufacturers should implement comprehensive risk management strategies:

Quality Management Systems

Implement robust quality management systems such as ISO/TS 16949 to ensure consistent product quality and reduce defect risks. Regular audits, statistical process control, and continuous improvement programs are essential.

Supplier Qualification and Monitoring

Establish rigorous supplier qualification processes and ongoing monitoring programs. Diversify supplier base to reduce dependency risks and maintain contingency plans for critical components.

Preventive Maintenance Programs

Implement comprehensive preventive maintenance programs for manufacturing equipment. Regular maintenance reduces breakdown risks and extends equipment life.

Safety Training and Protocols

Invest in comprehensive safety training programs and maintain strict safety protocols. Regular safety audits and incident reporting systems help identify and address potential hazards.

Cybersecurity Measures

Implement robust cybersecurity measures including firewalls, intrusion detection systems, employee training, and incident response plans. Regular security assessments and updates are crucial.

Choosing the Right Insurance Coverage

Selecting appropriate insurance coverage requires careful analysis of your specific risks, operations, and financial capacity. Consider the following factors:

Risk Assessment

Conduct comprehensive risk assessments to identify potential exposures. Consider both frequency and severity of potential losses, and prioritize coverage accordingly.

Coverage Limits

Determine appropriate coverage limits based on potential maximum loss scenarios. Consider the financial impact of product recalls, major equipment failures, and liability claims.

Deductibles and Retention

Balance premium costs with risk retention through appropriate deductible levels. Higher deductibles reduce premiums but increase out-of-pocket costs for claims.

Policy Terms and Conditions

Carefully review policy terms, conditions, and exclusions. Ensure coverage aligns with your specific operations and risk profile.

Insurer Financial Strength

Choose insurers with strong financial ratings and experience in automotive manufacturing risks. Consider their claims handling reputation and service capabilities.

Claims Management and Response

Effective claims management is crucial for minimizing losses and maintaining business continuity:

Immediate Response

Establish clear protocols for immediate claim reporting and response. Quick action can minimize losses and preserve evidence for claim investigations.

Documentation

Maintain detailed documentation of incidents, damages, and business impacts. Proper documentation supports claim submissions and expedites the claims process.

Legal and Technical Support

Engage legal counsel and technical experts early in the claims process. Their expertise can help navigate complex liability issues and technical investigations.

Communication Strategy

Develop a clear communication strategy for stakeholders, including customers, suppliers, and regulatory bodies. Transparent and proactive communication can mitigate reputational damage.

Future Trends in Automotive Components Manufacturing Insurance

Electric and Autonomous Vehicle Impact

The shift towards electric and autonomous vehicles is dramatically changing insurance requirements. Manufacturers must adapt to new risk profiles, including:

- Advanced electronic component liability

- Software and cybersecurity risks

- Battery and energy storage system protection

- Emerging technology liability

AI and Machine Learning in Risk Assessment

Insurers are increasingly using AI and machine learning to:

- Develop more precise risk pricing models

- Predict potential failure modes

- Create more personalized insurance solutions

- Enhance claims prediction and management

Sustainability and Environmental Considerations

Growing emphasis on sustainable manufacturing is influencing insurance products:

- Green manufacturing risk assessments

- Circular economy supply chain protection

- Carbon footprint liability coverage

- Sustainable material risk management

Parametric Insurance Solutions

Emerging insurance models offer more flexible protection:

- Predefined payouts for specific events

- Faster claims processing

- Coverage for complex supply chain disruptions

- More transparent risk transfer mechanisms

Conclusion: Protecting Your Automotive Components Manufacturing Business

The automotive components manufacturing sector operates in an increasingly complex and dynamic environment. Comprehensive insurance coverage is no longer a luxury but a critical business necessity. By understanding your unique risks, implementing robust risk management strategies, and selecting tailored insurance solutions, manufacturers can protect their operations, assets, and reputation.

Key takeaways include:

- Conduct thorough risk assessments

- Implement comprehensive insurance coverage

- Invest in proactive risk management

- Stay informed about emerging industry trends

- Work with specialized insurance providers

Protect Your Manufacturing Future

At Insure24, we specialize in crafting comprehensive insurance solutions for automotive components manufacturers. Our expert team understands the unique challenges of your industry and can help you develop a robust insurance strategy.

Contact us today for a free, no-obligation insurance consultation and take the first step towards comprehensive protection.

0330 127 2333

0330 127 2333