The …

Electronic Control Units (ECUs) Manufacturing Insurance: Protecting Your High-Tech Manufacturing Business

Understanding the Critical World of ECUs Manufacturing

In the rapidly evolving landscape of automotive and industrial technology, Electronic Control Units (ECUs) stand as the sophisticated brains behind modern machinery. As a manufacturer of these complex electronic systems, you're not just producing components – you're engineering the future of technological innovation. However, with great technological advancement comes significant risk, making comprehensive insurance protection not just a recommendation, but a critical business necessity.

What Are Electronic Control Units (ECUs)?

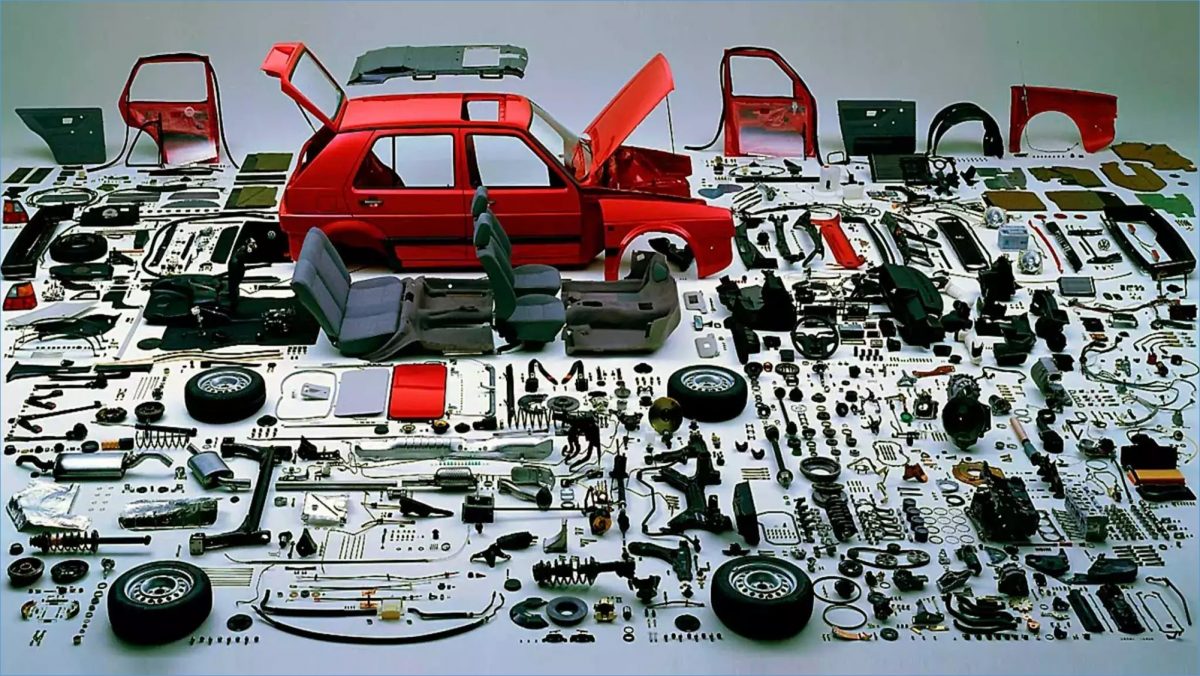

Electronic Control Units are specialized computing devices that control various electrical systems and subsystems in vehicles, industrial machinery, and advanced technological equipment. These microprocessor-powered units manage everything from engine performance and transmission systems to advanced driver-assistance features and climate control mechanisms.

Key Components of ECUs

- Microprocessors

- Memory chips

- Input/output interfaces

- Specialized software

- Communication protocols

Unique Risks in ECUs Manufacturing

The manufacturing of Electronic Control Units presents a complex array of risks that traditional insurance policies might not adequately address. Understanding these risks is the first step in developing a robust insurance strategy.

Technological Risks

- Rapid technological obsolescence

- Complex software and firmware vulnerabilities

- Cybersecurity threats

- Intellectual property challenges

Production Risks

- High-precision manufacturing requirements

- Expensive raw materials and components

- Sensitive electronic manufacturing environments

- Potential for manufacturing defects

Comprehensive Insurance Coverage for ECUs Manufacturers

A robust insurance strategy for ECUs manufacturers must be as sophisticated and multi-layered as the products being manufactured. Here are the critical insurance coverages to consider:

1. Product Liability Insurance

Protects against claims arising from potential defects in manufactured ECUs that might cause system failures, vehicle malfunctions, or industrial equipment breakdowns. This coverage is crucial given the critical nature of ECUs in modern technology.

2. Professional Indemnity Insurance

Covers legal expenses and compensation claims related to professional errors, design flaws, or technological advice that might result in financial losses for clients or end-users.

3. Cyber Insurance

Specifically designed for high-tech manufacturers dealing with complex electronic systems. Covers risks related to:

- Data breaches

- Cyber-attacks

- Intellectual property theft

- System disruption

- Ransomware protection

4. Property and Equipment Insurance

Protects your manufacturing facilities, specialized equipment, and sensitive electronic testing environments against risks such as:

- Fire

- Equipment breakdown

- Natural disasters

- Theft of high-value technological equipment

5. Business Interruption Insurance

Provides financial protection if manufacturing operations are disrupted due to covered events, ensuring continued revenue and support during recovery periods.

Risk Mitigation Strategies

Beyond insurance, proactive risk management is crucial in ECUs manufacturing. Consider implementing:

- Rigorous quality control processes

- Regular software and firmware updates

- Comprehensive testing protocols

- Continuous staff training

- Robust cybersecurity infrastructure

Emerging Trends in ECUs Manufacturing

The ECUs manufacturing landscape is continuously evolving, driven by trends such as:

- Electric and autonomous vehicle technologies

- Internet of Things (IoT) integration

- Advanced driver-assistance systems (ADAS)

- Artificial intelligence in vehicle/industrial systems

These trends not only present exciting opportunities but also introduce new and complex risk landscapes that require adaptive insurance solutions.

Conclusion: Protecting Your Technological Innovation

In the high-stakes world of ECUs manufacturing, comprehensive insurance is more than a protective measure – it's a strategic business asset. By understanding your unique risks and implementing a multi-layered insurance approach, you can safeguard your business, protect your innovations, and confidently navigate the complex technological landscape.

Frequently Asked Questions

Q1: How often should ECUs manufacturers review their insurance coverage?

Annually, or whenever significant technological changes occur in your manufacturing processes or product lines.

Q2: Are standard business insurance policies sufficient for ECUs manufacturers?

No. Specialized, technology-focused insurance policies are crucial due to the complex and high-risk nature of ECUs manufacturing.

Q3: How do emerging technologies impact insurance requirements?

Emerging technologies introduce new risks, requiring more sophisticated and adaptable insurance coverage that can evolve with technological advancements.

0330 127 2333

0330 127 2333