Cyber Insurance for Battery Manufacturers: Protecting Your Digital and Physical Assets

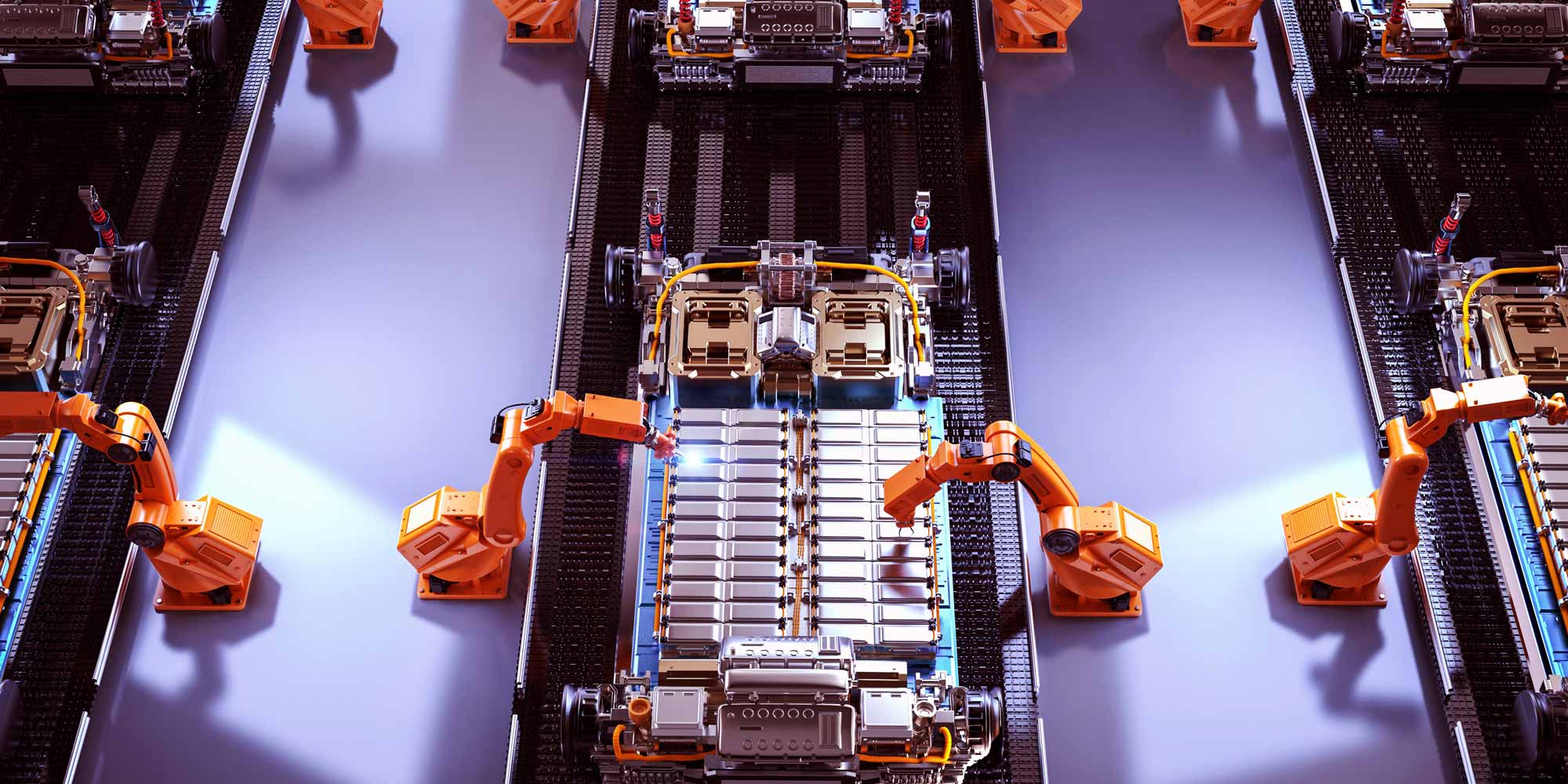

Introduction: The Digital Landscape of Battery Manufacturing

In an era of rapid technological advancement, battery manufacturers face unprecedented digital risks that extend far beyond traditional industrial hazards. Cyber threats have evolved from theoretical concerns to tangible business-destroying realities, making comprehensive cyber insurance not just a luxury, but a critical business survival strategy.

Understanding Cyber Risks in Battery Manufacturing

Unique Technological Vulnerabilities

Battery manufacturers operate in a complex technological ecosystem that includes:

- Advanced manufacturing control systems

- Proprietary design and research databases

- Supply chain management platforms

- Intellectual property repositories

- Customer and vendor communication networks

Potential Cyber Threat Scenarios

- Industrial Espionage: Competitors or state-sponsored actors attempting to steal proprietary battery design technologies

- Ransomware Attacks: Encryption of critical manufacturing control systems

- Supply Chain Disruption: Malicious interference with logistics and inventory management platforms

- Data Breach: Unauthorized access to customer, vendor, and internal confidential information

- Operational Technology (OT) Compromise: Potential manipulation of manufacturing equipment and quality control systems

The Financial Implications of Cyber Incidents

Cyber incidents in battery manufacturing can result in catastrophic financial consequences:

| Incident Type | Potential Cost Range | Business Impact |

|---|---|---|

| Data Breach | £50,000 - £2,000,000 | Reputation damage, legal penalties, customer trust erosion |

| Ransomware Attack | £100,000 - £5,000,000 | Production halt, recovery costs, potential permanent shutdown |

| Intellectual Property Theft | £500,000 - £10,000,000 | Competitive disadvantage, R&D investment loss |

Comprehensive Cyber Insurance for Battery Manufacturers

Key Coverage Components

First-Party Coverage

- Business Interruption Expenses

- Data Recovery and Restoration

- Cyber Extortion and Ransomware Protection

- Crisis Management and Public Relations

- Digital Asset Replacement

Third-Party Coverage

- Legal Defense Costs

- Regulatory Compliance Penalties

- Customer Data Breach Notification

- Intellectual Property Infringement Defense

- Network Security Liability

Proactive Cyber Risk Mitigation Strategies

While cyber insurance provides crucial financial protection, prevention remains paramount. Battery manufacturers should implement:

- Robust Cybersecurity Frameworks

- Multi-factor authentication

- Regular security audits

- Employee cybersecurity training

- Advanced endpoint protection

- Supply Chain Security

- Vendor risk assessment

- Secure communication protocols

- Continuous monitoring of third-party access

- Incident Response Planning

- Comprehensive incident response plan

- Regular tabletop exercise simulations

- Designated cyber incident response team

Selecting the Right Cyber Insurance Policy

Evaluation Criteria

When choosing cyber insurance, battery manufacturers should consider:

- Industry-specific coverage nuances

- Comprehensive risk assessment

- Flexibility and adaptability of policy

- Incident response support

- Claims handling reputation

Recommended Policy Features

Must-Have Components

- Technology Errors & Omissions Coverage

- Intellectual Property Protection

- Business Interruption Extension

- Worldwide Coverage

- Retroactive Coverage Option

Conclusion: Cyber Resilience in Battery Manufacturing

In the rapidly evolving landscape of battery technology and digital manufacturing, cyber insurance is not merely a financial instrument but a strategic imperative. By understanding risks, implementing robust mitigation strategies, and securing comprehensive coverage, battery manufacturers can protect their innovations, reputation, and future.

Frequently Asked Questions

- How much does cyber insurance cost for battery manufacturers?

- Costs vary based on company size, technological complexity, and risk profile, typically ranging from £5,000 to £50,000 annually.

- Can cyber insurance cover physical damage from a cyber attack?

- Some policies offer extensions for physical damage resulting from cyber incidents, but specifics vary by provider.

- How often should a cyber insurance policy be reviewed?

- Annually, or whenever significant technological changes or business expansions occur.

0330 127 2333

0330 127 2333