Battery Manufacturing Insurance Renewal Guide: Comprehensive Protection for Your Business in 2025

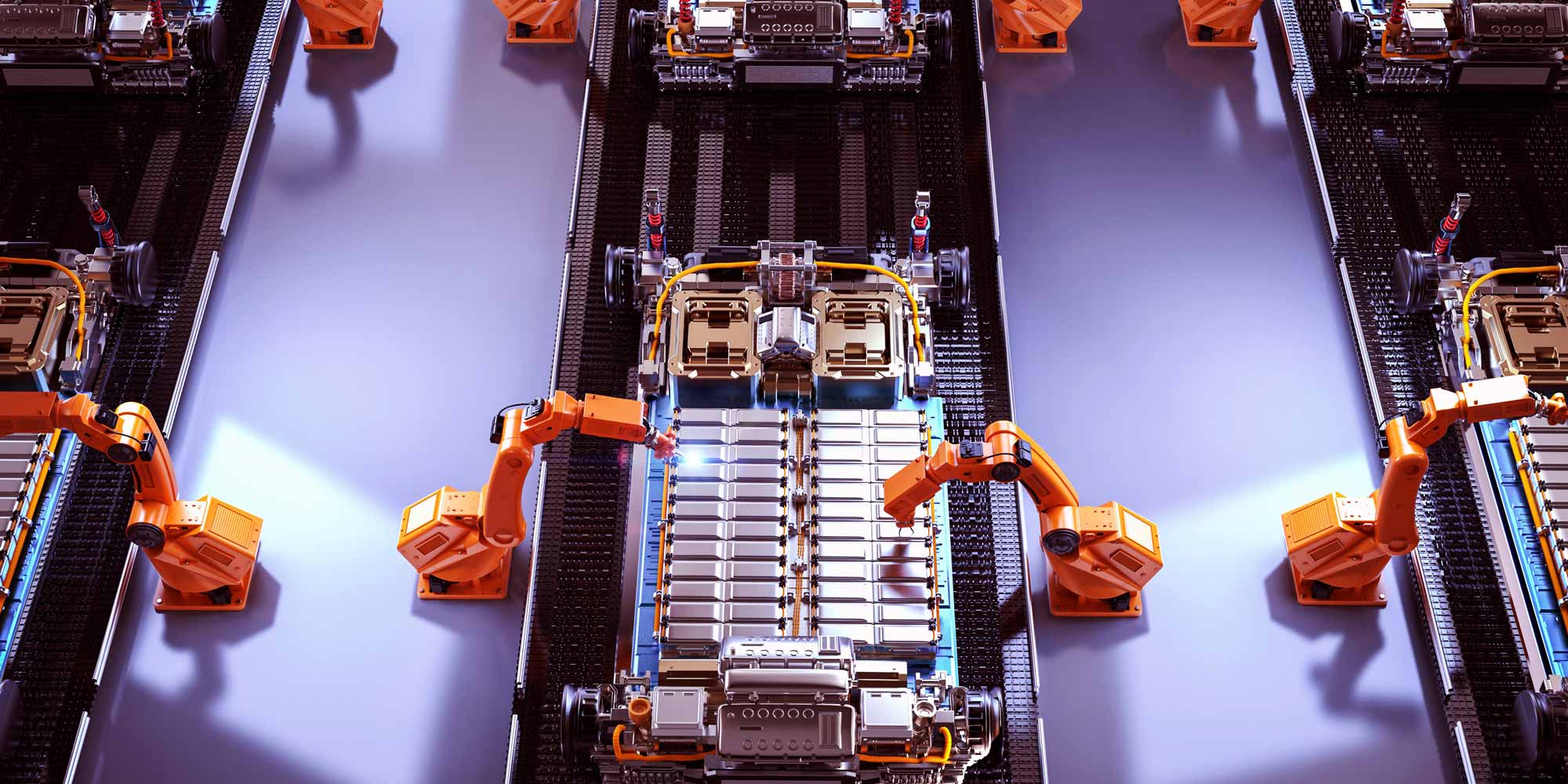

Introduction: The Critical Role of Insurance in Battery Manufacturing

As the battery manufacturing industry continues to evolve rapidly with technological advancements and increasing global demand, understanding and strategically managing your insurance portfolio has never been more crucial. This comprehensive guide will walk you through the essential considerations for insurance renewal in 2025, helping you protect your business against emerging risks and ensure comprehensive coverage.

The Evolving Battery Manufacturing Landscape

The battery manufacturing sector is experiencing unprecedented growth, driven by:

- Electric vehicle (EV) market expansion

- Renewable energy storage solutions

- Consumer electronics demand

- Government sustainability initiatives

These dynamics introduce complex and evolving risk profiles that demand sophisticated insurance strategies.

Identifying Critical Risks in Battery Manufacturing

1. Property and Equipment Risks

Battery manufacturing involves sophisticated, high-value equipment and processes that are vulnerable to:

- Fire and explosion hazards

- Chemical contamination

- Machinery breakdown

- Technology obsolescence

2. Product Liability Challenges

With battery technologies powering critical infrastructure and transportation, product liability risks are significant:

- Potential performance failures

- Safety incidents

- Environmental contamination

- Recall scenarios

3. Cyber and Intellectual Property Risks

Advanced battery manufacturing relies heavily on proprietary technologies, exposing businesses to:

- Cyber attacks

- Intellectual property theft

- Industrial espionage

- Data breach vulnerabilities

Essential Insurance Coverage for Battery Manufacturers

1. Commercial Combined Insurance

A comprehensive policy covering multiple risk dimensions:

- Property damage protection

- Business interruption coverage

- Equipment breakdown insurance

- Stock and inventory protection

2. Product Liability Insurance

Critical for managing risks associated with battery manufacturing:

- Legal defense costs

- Compensation for product-related incidents

- Recall expense coverage

- Global market protection

3. Cyber Insurance

Specialized protection for technological risks:

- Data breach response

- Cyber extortion coverage

- Business interruption from cyber incidents

- Intellectual property protection

4. Professional Indemnity Insurance

Protection for professional services and consultancy risks:

- Design and engineering liability

- Technological consultation coverage

- Errors and omissions protection

Strategic Insurance Renewal Approach for 2025

1. Comprehensive Risk Assessment

Before renewal, conduct a thorough evaluation of:

- Current manufacturing processes

- Technological investments

- Expansion plans

- Emerging market risks

2. Documentation and Evidence Gathering

Prepare robust documentation demonstrating:

- Safety protocols

- Quality control measures

- Risk management strategies

- Technological compliance

3. Negotiation and Comparison

Effective renewal strategies include:

- Obtaining multiple quotes

- Negotiating coverage terms

- Understanding policy exclusions

- Exploring customized packages

2025 and Beyond: Emerging Insurance Considerations

The battery manufacturing sector is witnessing transformative trends:

- Sustainable battery technologies

- Circular economy integration

- Advanced recycling processes

- International regulatory compliance

Insurance providers are developing specialized products addressing these emerging challenges.

Conclusion: Proactive Protection in a Dynamic Industry

Battery manufacturing insurance is not a static requirement but a dynamic, strategic asset. By understanding risks, maintaining comprehensive coverage, and adopting a forward-looking approach, businesses can navigate uncertainties and capitalize on growth opportunities.

Frequently Asked Questions

Q1: How often should battery manufacturers review their insurance?

Annually, or immediately after significant technological or operational changes.

Q2: Are international operations covered?

Specialized global coverage options are available; discuss specific requirements with your insurance provider.

Q3: How do emerging technologies impact insurance?

Insurers continuously adapt policies to address technological risks and innovations.

0330 127 2333

0330 127 2333