Gigafactory Insurance: Protecting the Future of Battery Manufacturing

A Comprehensive Guide to Risk Management in Advanced Battery Production

Understanding the Unique Insurance Landscape of Gigafactories

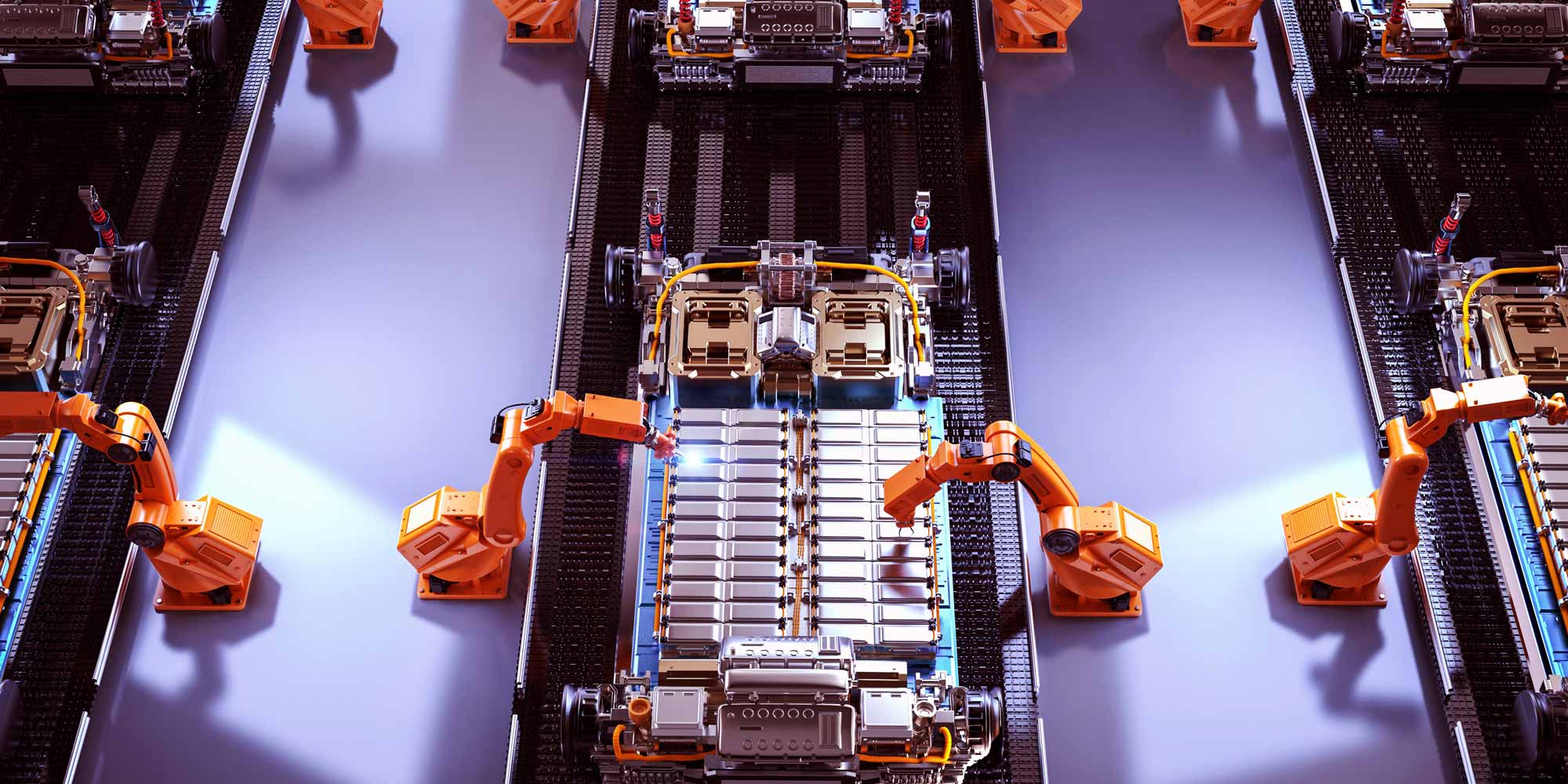

As the world transitions towards sustainable energy and electric transportation, gigafactories have emerged as critical infrastructure for battery production. These massive manufacturing facilities represent substantial investments and face complex, multifaceted risks that demand specialized insurance solutions.

Comprehensive Risk Assessment for Gigafactories

Property and Physical Asset Protection

Gigafactories house millions of dollars worth of sophisticated equipment, raw materials, and in-process battery components. Key insurance considerations include:

- High-value manufacturing equipment replacement

- Protection against technological breakdown

- Coverage for specialized production lines

- Environmental control system failures

Chemical and Material Hazards

Battery production involves complex chemical processes with inherent risks:

- Lithium-ion battery chemical instability

- Potential thermal runaway scenarios

- Hazardous material storage and handling

- Fire suppression and containment strategies

Essential Insurance Coverage for Gigafactories

1. Property Insurance

Comprehensive property insurance for gigafactories must account for:

- Building and infrastructure protection

- Manufacturing equipment replacement

- Raw material and finished product inventory

- Advanced technological systems

2. Product Liability Insurance

Critical for managing risks associated with battery manufacturing:

- Coverage for potential battery performance failures

- Protection against manufacturing defects

- Recalls and remediation expenses

- Third-party damage claims

3. Business Interruption Insurance

Given the complex production processes, business interruption coverage is crucial:

- Revenue protection during unexpected shutdowns

- Supply chain disruption mitigation

- Equipment breakdown recovery

- Contingent business interruption

4. Cyber Insurance

Modern gigafactories rely heavily on digital systems, necessitating robust cyber protection:

- Industrial control system security

- Data breach and privacy protection

- Ransomware and cyber extortion coverage

- Technological system restoration

5. Environmental Liability Insurance

Battery production involves complex environmental considerations:

- Chemical spill and contamination coverage

- Hazardous waste management protection

- Regulatory compliance support

- Remediation expense coverage

Advanced Risk Mitigation Strategies

Technology and Prevention

Insurers increasingly expect advanced risk management:

- Real-time monitoring systems

- Predictive maintenance technologies

- Comprehensive safety protocols

- Regular third-party risk assessments

Real-World Insurance Scenarios

Case Study: Battery Production Line Failure

A gigafactory experienced a critical production line failure due to unexpected chemical instability. Comprehensive insurance coverage facilitated:

- Immediate equipment replacement

- Business interruption compensation

- Rapid recovery and minimal production downtime

The Evolving Landscape of Gigafactory Insurance

As battery technology advances, insurance products will continue to adapt, offering more sophisticated, technology-driven risk management solutions.

Conclusion: Protecting Innovation

Gigafactory insurance represents a complex, dynamic field requiring specialized knowledge, advanced risk assessment, and flexible coverage strategies. By understanding and proactively managing risks, manufacturers can safeguard their critical infrastructure and continue driving sustainable technological innovation.

0330 127 2333

0330 127 2333